Understanding the Different Business Structures for Company Formation in the Netherlands

When it comes to starting a business in the Netherlands, understanding the different business structures is crucial. The right business structure can have a significant impact on your company's legal and financial obligations. In this article, we will explore the main types of business structures available for company formation in the Netherlands.

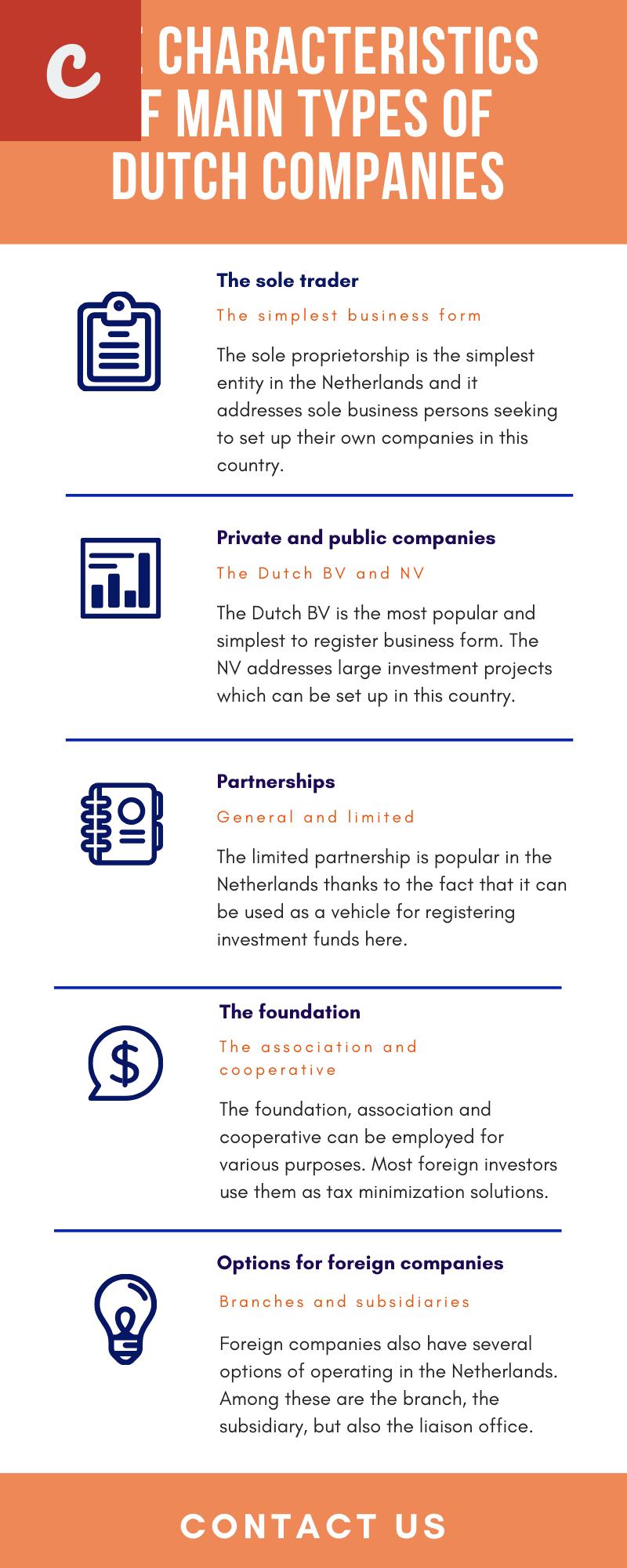

Sole Proprietorship: A sole proprietorship is the simplest and most straightforward business structure. It is suitable for individuals who want to run their business independently. As a sole proprietor, you are personally responsible for all the company's debts and obligations. This type of structure is relatively easy and inexpensive to set up, making it a popular choice for small businesses and freelancers.

Partnership: A partnership is formed when two or more individuals decide to join forces and start a business together. In a general partnership, all partners are equally liable for the company's debts and obligations. It is important to have a written partnership agreement in place to outline the rights and responsibilities of each partner. Limited partnerships are also an option, where there are both general partners and limited partners. Limited partners have limited liability, while general partners have unlimited liability.

- Limited Liability Company (LLC): A limited liability company provides a separate legal entity, distinct from its owners. This means that the owners, known as shareholders, have limited liability, protecting their personal assets. The formation of an LLC requires a notarial deed and registration with the Dutch Chamber of Commerce. This structure is commonly chosen by businesses that intend to grow and seek outside investment.

- Private Limited Company (BV): A private limited company, known as BV (Besloten Vennootschap) in the Netherlands, is similar to an LLC. It offers limited liability for shareholders while providing additional benefits, such as corporate tax advantages and flexibility in managing the company. A BV must also have a minimum share capital of €0.01 and is required to maintain proper accounting records.

Public Limited Company (NV): A public limited company, known as NV (Naamloze Vennootschap) in the Netherlands, is a suitable structure for larger businesses with plans to go public or have a significant number of shareholders. The formation of an NV requires a minimum share capital of €45,000 and is subject to additional reporting and disclosure requirements.

Choosing the right business structure depends on various factors, including the size of your business, your growth plans, and your potential liabilities. It is recommended to seek legal and financial advice to ensure you make an informed decision that aligns with your business goals.

In conclusion, understanding the different business structures for company formation in the Netherlands is essential for entrepreneurs and business owners. Whether you opt for a sole proprietorship, partnership, limited liability company, or a private or public limited company, each structure comes with its own set of benefits and legal responsibilities. By selecting the appropriate business structure, you can set a strong foundation for your business and navigate the Dutch business landscape with confidence.

Main Title: A Guide to Selecting the Optimal Business Structure for Company Formation in the Netherlands

When starting a business in the Netherlands, one of the most important decisions you need to make is choosing the right business structure. The business structure you choose will determine various aspects of your company, such as legal liabilities, tax obligations, and operational flexibility. It's crucial to understand the different options available to make an informed decision that fits your specific needs. This guide aims to help you navigate through the various business structures and select the optimal one for your company formation in the Netherlands.

Before diving into the various business structures, it's essential to highlight the importance of conducting thorough market research and seeking professional advice. Each business structure has its own set of legal requirements, advantages, and disadvantages. Therefore, it's crucial to assess your business goals, operations, and long-term visions before making a decision.

- List item 1: Sole Proprietorship: Ideal for individuals looking to start a business with full control and low setup costs. As a sole proprietor, you are solely responsible for all business liabilities, and your personal assets are at risk. It's worth considering if you are operating as a freelancer, consultant, or running a small-scale business.

- List item 2: Partnership: Suitable for multiple individuals who want to start a business together. There are different types of partnerships available, such as general partnerships and limited partnerships. In general partnerships, all partners have unlimited liability, while in limited partnerships, there is at least one general partner with unlimited liability and one limited partner with liability limited to their capital contribution.

For more complex business setups or those planning to expand rapidly, the Netherlands offers two commonly used business structures:

- List item 3: Private Limited Liability Company (BV): Often referred to as a BV, this business structure offers limited liability for its shareholders. It's an independent legal entity that protects the personal assets of its shareholders. It requires a minimum share capital, and the company's management is carried out by its directors. A BV is well-suited for businesses aiming for long-term growth and seeking investment opportunities.

- List item 4: Public Limited Liability Company (NV): A NV is similar to a BV, but with the additional requirement of having its shares listed on a stock exchange. This structure is ideal for businesses planning to go public or attracting significant capital from a large number of shareholders. It involves a more complex legal and financial framework, including additional accounting and reporting obligations to meet statutory requirements.

Remember, this guide provides a general overview of the available business structures in the Netherlands. It's advisable to consult with a legal or tax professional who can guide you through the specific regulations and help you make the right choice for your company formation needs.

In conclusion, selecting the optimal business structure for your company formation in the Netherlands is a crucial step towards building a successful business. Consider your goals, liabilities, and long-term visions when exploring the various options. Seek professional advice to ensure compliance with legal requirements and make an informed decision that aligns with your business objectives.

Comparing Business Structure Options for Company Formation in the Netherlands

Are you considering starting a business in the Netherlands and wondering which business structure would be the best fit for you? Each business structure option has its own advantages and considerations, so it's important to understand the differences before making a decision. In this article, we will compare the main business structure options available for company formation in the Netherlands.

Sole Proprietorship: A sole proprietorship is the simplest form of business structure in the Netherlands. It is suitable for individuals who want to start a business on their own without any partners. As a sole proprietor, you have complete control over your business, but you are also personally liable for any debts or legal obligations.

Partnership: A partnership may be appropriate if you want to start a business with one or more partners. There are two types of partnerships in the Netherlands: general partnerships (VOF) and limited partnerships (CV). In a general partnership, all partners are equally liable for debts and obligations. In a limited partnership, there are general partners who are fully liable, and limited partners who have limited liability.

- General Partnership (VOF): This type of partnership is suitable for businesses where all partners want to share equally in the management and are willing to accept joint liability for debts and obligations. It is important to have a partnership agreement in place that outlines the roles, responsibilities, and profit-sharing arrangements.

- Limited Partnership (CV): In a limited partnership, there are general partners who manage the business and have unlimited liability, and limited partners who contribute capital but have limited liability. Limited partners are not involved in the day-to-day management of the business.

Private Limited Company (BV): The BV is the most common form of business structure used by entrepreneurs in the Netherlands. It offers limited liability to its shareholders, which means their personal assets are protected. The BV requires a minimum share capital of €0.01 and must have at least one shareholder and one director. Registering a BV involves more administrative tasks and costs compared to other business structures.

Public Limited Company (NV): The NV is similar to a BV but is usually chosen by larger, publicly traded companies. It requires a minimum share capital of €45,000 and is subject to additional reporting and disclosure requirements. The NV structure allows for raising capital through public offerings of shares.

It is important to consider various factors such as liability, tax implications, administrative requirements, and the nature of your business when choosing a business structure in the Netherlands. Consulting with a legal or tax advisor can help you make an informed decision based on your specific circumstances.

Before finalizing your decision, ensure you have thoroughly researched each option and weighed the pros and cons. The chosen business structure will have a significant impact on your business and its future growth. Good luck with your new venture!

Main Title: Key Factors to Consider When Choosing a Business Structure for Company Formation in the Netherlands

Starting a business in the Netherlands can be an exciting and rewarding venture. However, before you begin the process of company formation, it is crucial to consider the right business structure that suits your needs. The business structure you choose will have long-term ramifications for your company's growth, legal obligations, and tax liabilities. To make an informed decision, pay attention to the following key factors.

1. Liability Protection: One of the primary considerations when choosing a business structure is the level of liability protection it offers. Some structures, such as sole proprietorships and general partnerships, do not provide limited liability, making the owner personally responsible for the company's debts and obligations. On the other hand, a limited liability company (LLC) or a private limited company (BV) can shield your personal assets from business liabilities.

2. Tax Implications: Taxes can significantly impact your business's earnings and financial stability. Each business structure comes with its own tax obligations and benefits. For instance, a sole proprietorship and general partnership come with personal income tax obligations, while an LLC or BV has corporate tax requirements. Consulting a tax professional will help you understand the tax implications of each structure and choose the most suitable one for your business.

- List item 1: Sole Proprietorship: Suitable for solo entrepreneurs, easy and cost-effective to set up, but offers no liability protection.

- List item 2: General Partnership: Suitable for businesses with multiple owners, where partners share profits, losses, and liabilities.

3. Flexibility: Consider the level of flexibility you require for your business operations. Some structures provide more flexibility than others. A sole proprietorship or general partnership allows for quick decision-making and less bureaucratic formalities. However, an LLC or BV may be more suitable if you anticipate future growth, changes in ownership, or want to attract external investors.

4. Ownership and Management: Determining the ownership and management structure is crucial when choosing a business entity. In a sole proprietorship, you have complete control and ownership, but in partnerships, decision-making is shared. If you prefer centralized control and ownership, a BV or LLC might be the better option as they have a clear structure and defined roles for shareholders and directors.

5. Costs and Administrative Burden: Consider the costs and administrative requirements associated with each business structure. Sole proprietorships and general partnerships are relatively inexpensive to set up and have fewer regulatory requirements. On the other hand, establishing an LLC or BV may involve higher fees, legal documentation, and ongoing compliance obligations. Evaluating your budget and capacity to manage administrative duties will help you make an informed decision.

In conclusion, when considering company formation in the Netherlands, carefully evaluate these key factors: liability protection, tax implications, flexibility, ownership and management structure, and costs/administrative burden. By doing so, you can choose the most suitable business structure that aligns with your goals, protects your interests, and sets the foundation for a successful venture.

Main Title: Exploring Business Structure Choices for Company Formation in the Netherlands

The Netherlands is a popular destination for entrepreneurs looking to establish a company due to its favorable business environment and access to the European market. When starting a business in the Netherlands, one of the key decisions to make is choosing the right business structure. The business structure you select will determine the legal and financial responsibilities of your company, as well as the tax implications. This article will explore the various business structure choices available for company formation in the Netherlands.

Limited Liability Company (BV)

A Limited Liability Company (BV) is the most common form of business structure in the Netherlands. BV provides limited liability protection to its shareholders, meaning their personal assets are not at risk in case of bankruptcy. A BV can be established by just one director and one shareholder, and the minimum share capital required is €0.01. The BV structure offers flexibility, as it allows for different classes of shares with varying voting rights.

- Pros:

- - Limited liability protection for shareholders.

- - Flexibility in share classes and voting rights.

- - Minimal share capital requirement.

- Cons:

- - Higher administrative and operational costs compared to other structures.

- - Mandatory financial reporting and auditing requirements.

- - Limited privacy for shareholders, as the BV's financial statements are publicly available.

Cooperative (Coop)

A Cooperative (Coop) is another business structure option in the Netherlands. It is suitable for companies with a collaborative business model, where members work together to achieve common goals. A Coop can be established by at least two members, and each member's liability is limited to their contribution to the cooperative. The members have equal voting rights, regardless of the size of their contributions.

- Pros:

- - Limited liability for members.

- - Equal voting rights for all members.

- - Flexibility in profit distribution.

- Cons:

- - Limited availability for external financing.

- - Potentially complex decision-making processes due to equal voting rights.

- - Members have joint liability for the cooperative's debts.

Sole Proprietorship (Eenmanszaak)

A Sole Proprietorship, also known as Eenmanszaak, is the simplest and most cost-effective business structure in the Netherlands. It allows an individual to start a business on their own without the need for additional shareholders or directors. In a Sole Proprietorship, the individual and the business are considered the same legal entity, which means the owner has unlimited personal liability for the company's debts. Unlike other business structures, there is no legal distinction between personal and business assets.

- Pros:

- - Easy and inexpensive to set up.

- - No minimum share capital requirement.

- - Complete control over business decisions and operations.

- Cons:

- - Unlimited personal liability for business debts.

- - Difficulty in raising external financing.

- - Limited opportunities for business expansion.

Conclusion

When establishing a company in the Netherlands, choosing the right business structure is crucial. The Limited Liability Company (BV) offers flexibility and limited liability protection, making it a popular choice for entrepreneurs. The Cooperative (Coop) is suitable for businesses with a collaborative model, while the Sole Proprietorship (Eenmanszaak) is a viable option for individuals looking for simplicity and full control over their business. Consider the pros and cons of each structure and consult with legal and financial professionals to determine the best choice for your specific business needs.

Comments on "Choosing The Right Business Structure For Company Formation In The Netherlands"

No comment found!