Understanding the Distinction: Branch Registration vs. Setting Up a Dutch BV as a Subsidiary

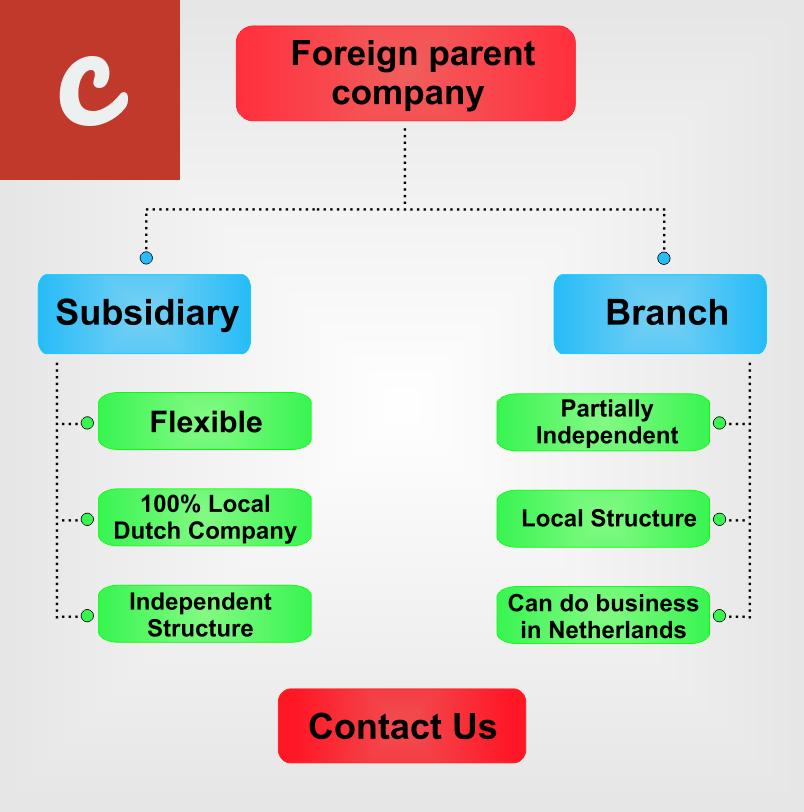

Are you a foreign company planning to expand your business to the Netherlands? If so, it's essential to understand the two main options available to you: branch registration and setting up a Dutch BV as a subsidiary. While both options allow you to establish a presence in the Netherlands, there are significant differences between the two.

Branch Registration: Branch registration is the process of registering a foreign company as an extension of its parent company in the Netherlands. It enables the parent company to operate under its own name and conduct business activities similar to those it carries out in its home country.

There are several advantages of branch registration. Firstly, it allows for a quicker and simpler setup process compared to establishing a Dutch BV. Additionally, as a branch, the parent company retains full control over the operations and decision-making. This option is also favorable for companies looking to maintain a unified brand identity across different jurisdictions.

However, it's important to note that a branch does not have a distinct legal personality from the parent company. This means that the parent company is responsible for all obligations and liabilities incurred by the branch. Furthermore, the parent company's financials are generally consolidated with those of the branch, which can have tax implications.

Setting Up a Dutch BV as a Subsidiary: On the other hand, setting up a Dutch BV (Besloten Vennootschap) as a subsidiary involves establishing a separate legal entity in the Netherlands. This option provides limited liability protection to the parent company, as the Dutch BV is considered a separate legal entity with its own assets and liabilities.

One of the primary benefits of setting up a Dutch BV as a subsidiary is the limited liability it offers. The parent company's liability is generally restricted to the amount invested in the Dutch BV, minimizing potential risks. This option also allows for greater flexibility in terms of equity ownership and profit distribution.

However, establishing a Dutch BV involves a more complex and time-consuming setup process compared to branch registration. It requires fulfilling specific legal requirements, such as drafting articles of association, appointing directors, and submitting documents to the Chamber of Commerce. Additionally, the Dutch BV may need to adhere to specific corporate governance and reporting obligations.

- Branch Registration Advantages:

- Quick and simple setup process

- Retains full control over operations

- Maintains a unified brand identity

- Setting Up a Dutch BV as a Subsidiary Advantages:

- Limited liability protection

- Greater flexibility in equity ownership and profit distribution

In conclusion, when deciding between branch registration and setting up a Dutch BV as a subsidiary, it's crucial to carefully consider the specific needs and goals of your company. Consulting with legal and tax professionals familiar with Dutch corporate laws can help you make an informed decision and navigate the process smoothly.

Comparing Branch Registration and Setting Up a Dutch BV as a Subsidiary: Key Differences

When expanding your business into new territories, it's important to understand the local regulations and determine the most suitable legal entity for your operations. In the Netherlands, two common options for foreign companies to establish a presence are by branch registration or setting up a Dutch BV (Besloten Vennootschap) as a subsidiary. While both options allow you to conduct business in the country, there are key differences to consider. Let's dive into the details.

1. Legal Entity: Branch registration involves establishing a Dutch branch of your existing company, which essentially operates as an extension of the parent company. On the other hand, setting up a Dutch BV creates a separate legal entity, offering limited liability protection to shareholders.

2. Liability: When it comes to liability, branch registration does not provide limited liability protection. The parent company is fully responsible for the debts and obligations of the branch. Conversely, a Dutch BV offers limited liability, where the shareholders' liability is limited to their investment in the company.

3. Capital Requirements: Branch registration does not require a minimum capital contribution, as it is considered part of the parent company. In contrast, setting up a Dutch BV entails a minimum share capital of €0.01. However, it's important to note that in practice, companies often invest more capital to support their operations in the Netherlands.

4. Governance and Control: The governance structure differs between branch registration and a Dutch BV. In a branch, the decision-making authority lies with the parent company, which operates and controls the branch's activities. On the other hand, a Dutch BV has its own management board, granting more autonomy to the subsidiary's directors.

- 5. Repatriation of Profits: One important aspect for international businesses is the repatriation of profits. With branch registration, repatriation is relatively straightforward, as income is consolidated with the parent company's financials. However, a Dutch BV operates independently, allowing for more flexibility in profit repatriation, subject to local tax regulations.

- 6. Taxation: Tax considerations play a significant role in choosing between branch registration and a Dutch BV. A branch is considered an extension of the parent company for tax purposes, and profits are typically subject to taxation in the home country. Conversely, a Dutch BV is subject to Dutch corporate tax, but can also benefit from various tax incentives and favorable tax treaties.

Considering these key differences, it's essential to assess your company's specific needs, goals, and long-term plans when deciding between branch registration and setting up a Dutch BV as a subsidiary in the Netherlands. Consulting with legal and tax advisors can help you navigate the complexities and make an informed decision for a successful expansion.

Main Title

Starting a business in a foreign country can be a complex process that requires careful consideration and planning. When expanding operations into the Netherlands, there are two main avenues that companies can choose from: branch registration and establishing a Dutch BV as a subsidiary. Both options have their own advantages and considerations, so it's essential to understand the differences between them before making a decision.

Branch registration involves setting up a representative office of the company in the Netherlands. It's considered an extension of the parent company and operates under its name. This option is suitable for companies looking to maintain a strong connection between the head office and the Dutch operations. The branch does not have a separate legal identity, which means the parent company is fully responsible for the obligations and liabilities of the branch.

On the other hand, establishing a Dutch BV (Besloten Vennootschap) involves creating a separate legal entity in the form of a limited liability company. The BV operates independently from the parent company and has its own obligations and liabilities. This option provides more separation between the parent company and the Dutch operations. It also offers limited liability protection, meaning the shareholders' liability is limited to their investment in the BV.

- List item 1: One of the essential differences between branch registration and a Dutch BV is the legal entity itself. While a branch has no legal separation from the parent company, a BV is its own legal entity.

- List item 2: Liability is another significant factor to consider. With a branch, the parent company is fully responsible for the branch's obligations and liabilities. In contrast, a Dutch BV offers limited liability protection for its shareholders.

It's also worth noting that establishing a Dutch BV requires more administrative work and compliance with local regulations compared to branch registration. The process of incorporating a BV involves drafting articles of association, appointing directors, and registering with the Dutch Chamber of Commerce. On the other hand, branch registration is relatively simpler, requiring fewer formalities.

When it comes to taxation, both options have their own implications. A Dutch BV is subject to corporate income tax in the Netherlands, while a branch will be taxed as part of the parent company's tax return.

In summary, the choice between branch registration and establishing a Dutch BV as a subsidiary depends on various factors such as the level of control desired, liability considerations, administrative requirements, and tax implications. It's crucial to consult with legal and tax professionals to determine the best approach for your specific circumstances.

Branch Registration vs. Dutch BV Subsidiary: Which Option Is Right for You?

Expanding your business into a new country can be an exciting and lucrative opportunity. When it comes to entering the Dutch market, there are two main options to consider: branch registration and setting up a Dutch BV subsidiary. Both options have their own advantages and considerations, so it's important to understand which one suits your business needs.

Branch Registration:

A branch registration allows you to establish a physical presence in the Netherlands without the need to set up a separate legal entity. This option may be preferable if you want to maintain centralized control over your business operations. A branch registration is considered an extension of your existing company, and your head office will remain the ultimate decision-making authority.

However, it's important to note that a branch registration does not provide limited liability protection. Your head office will be liable for all debts and obligations incurred by the branch in the Netherlands. This means that your entire business's assets are at risk if the branch faces legal or financial difficulties.

Another consideration is taxation. Branch registrations are subject to the same tax laws as Dutch-resident companies. This means that profits generated by the branch are subject to Dutch corporate tax. However, double taxation avoidance agreements may apply, depending on the country of origin of the head office.

Dutch BV Subsidiary:

Setting up a Dutch BV subsidiary involves creating a separate legal entity in the Netherlands. This option provides several advantages, including limited liability protection. The subsidiary is a separate entity from the parent company, meaning that the parent company's assets are generally protected in case of any legal or financial issues faced by the subsidiary.

Another advantage of a Dutch BV subsidiary is the potential to benefit from various favorable tax incentives. The Netherlands has an extensive tax treaty network and offers several tax planning opportunities. It's worth consulting with tax advisors to explore the potential tax benefits for your specific situation.

However, establishing a Dutch BV subsidiary can involve more administrative and legal complexities compared to a branch registration. It requires creating a separate legal entity, adhering to Dutch company law, and maintaining proper corporate governance. This option may be more suitable for businesses planning long-term expansion and growth in the Netherlands.

- Key differences to consider:

- A branch registration offers centralized control, while a Dutch BV subsidiary provides more independence.

- A branch registration does not offer limited liability protection, whereas a Dutch BV subsidiary does.

- Tax implications differ between the two options, with potential advantages for a Dutch BV subsidiary.

- A Dutch BV subsidiary involves more administrative and legal complexities compared to a branch registration.

Ultimately, the choice between a branch registration and a Dutch BV subsidiary depends on your business objectives, risk tolerance, and long-term plans. Consulting with legal and tax experts can help you make an informed decision based on your specific circumstances.

Whether you opt for a branch registration or a Dutch BV subsidiary, expanding your business to the Netherlands can open up a wealth of opportunities in a thriving European market. Understanding the pros and cons of each option will help you make the right choice for your business.

The Difference between branch registration and the set up of a Dutch BV as a subsidiary is a topic that is often discussed in business and legal circles. When it comes to establishing a presence in a foreign market, companies have the option of either registering a branch or setting up a Dutch BV subsidiary. A branch registration involves creating a local presence for a company within a foreign country, maintaining a direct connection to the parent company. On the other hand, setting up a Dutch BV subsidiary entails establishing a separate legal entity that is owned by the parent company. This subsidiary operates independently and has its own corporate identity. To learn more about the nuances and benefits of each option, you can visit the House of Companies website where they provide comprehensive information on this topic.

Choosing Between Branch Registration and Setting Up a Dutch BV as a Subsidiary: A Comprehensive Guide

When expanding your business internationally, setting up a subsidiary is a common way to establish a presence in a foreign market. In the Netherlands, you have two options for doing so: branch registration or setting up a Dutch BV (Besloten Vennootschap).

Branch Registration:

Branch registration involves establishing a local presence for your company without creating a separate legal entity. It means that your parent company continues to have full liability for the branch's actions. This option is suitable if you want a simple and cost-effective way to operate in the Netherlands.

- Advantages:

- Easier and faster setup process.

- No need for share capital requirements.

- No need to comply with strict reporting and governance obligations of a BV.

- Disadvantages:

- Parent company remains fully liable for branch's obligations.

- No separate legal identity for the branch.

- Can be perceived as less trustworthy by potential clients.

Setting Up a Dutch BV:

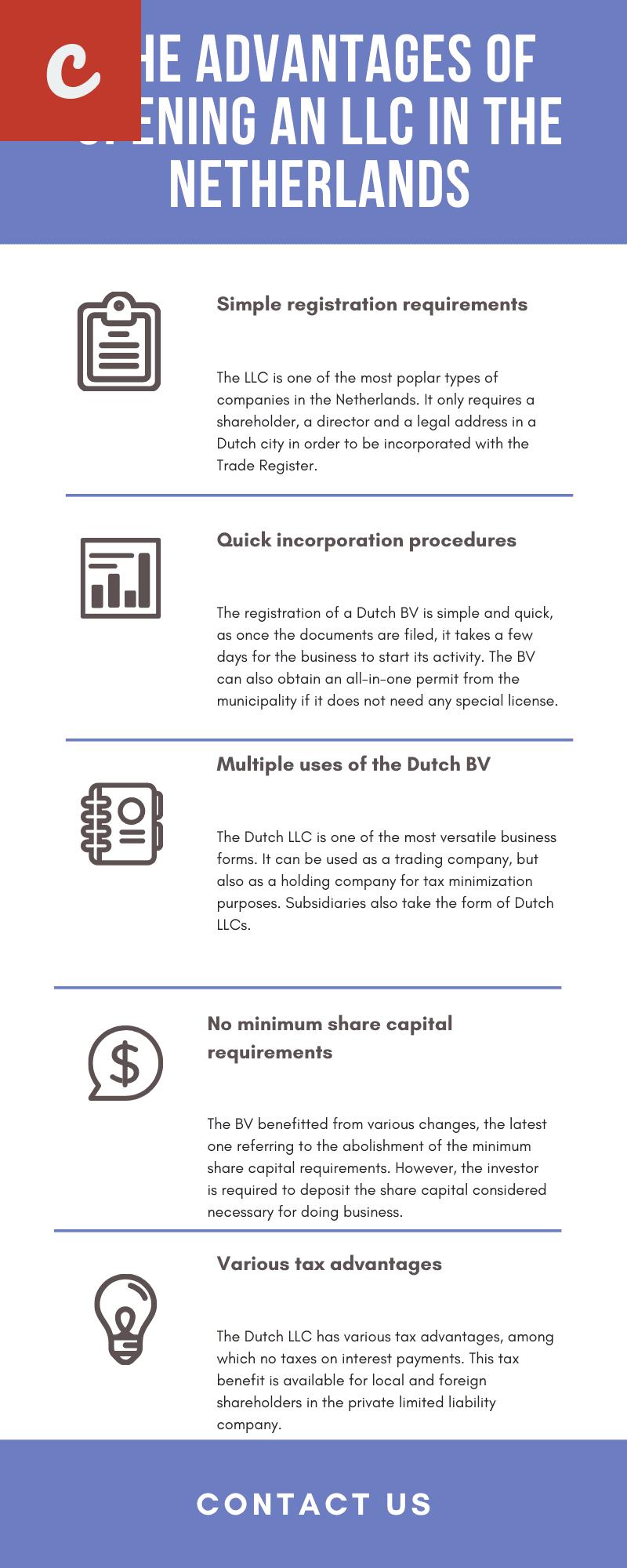

A Dutch BV is a separate legal entity with limited liability. It requires the formation of a new company independent of your parent company. This option is ideal if you want a more formal and independent presence in the Netherlands.

- Advantages:

- Separate legal entity, limited liability for shareholders.

- Increased credibility and trustworthiness.

- Opportunity to access Dutch tax advantages.

- Disadvantages:

- Complex formation process.

- Minimum share capital requirement of €0.01.

- Higher setup and ongoing compliance costs.

Which option to choose?

The decision between branch registration and setting up a Dutch BV depends on various factors. If you have a small operation or want to test the market, branch registration may be adequate. On the other hand, if you plan to have a substantial presence and gain credibility, a Dutch BV is recommended.

Consider aspects such as liability, cost, reporting requirements, and long-term goals. Speaking with legal and tax advisors can help you make an informed decision based on your specific circumstances.

In conclusion, both branch registration and setting up a Dutch BV have their pros and cons. It's essential to evaluate your business needs and goals to determine the right option for your expansion into the Netherlands. Consulting professionals will provide valuable insights and ensure a smooth process.

Comments on "Difference Between Branch Registration And The Set Up Of A Dutch BV As Subsidiary "

No comment found!