Opening a Company Bank Account in the Netherlands: A Step-by-Step Guide

Are you starting a business and looking to open a company bank account in the Netherlands? Having a separate bank account for your business can help you manage your finances more effectively. It also adds credibility to your company and improves transparency when it comes to your financial transactions. Here is a step-by-step guide to help you navigate through the process.

Paragraph 1: Researching Banks

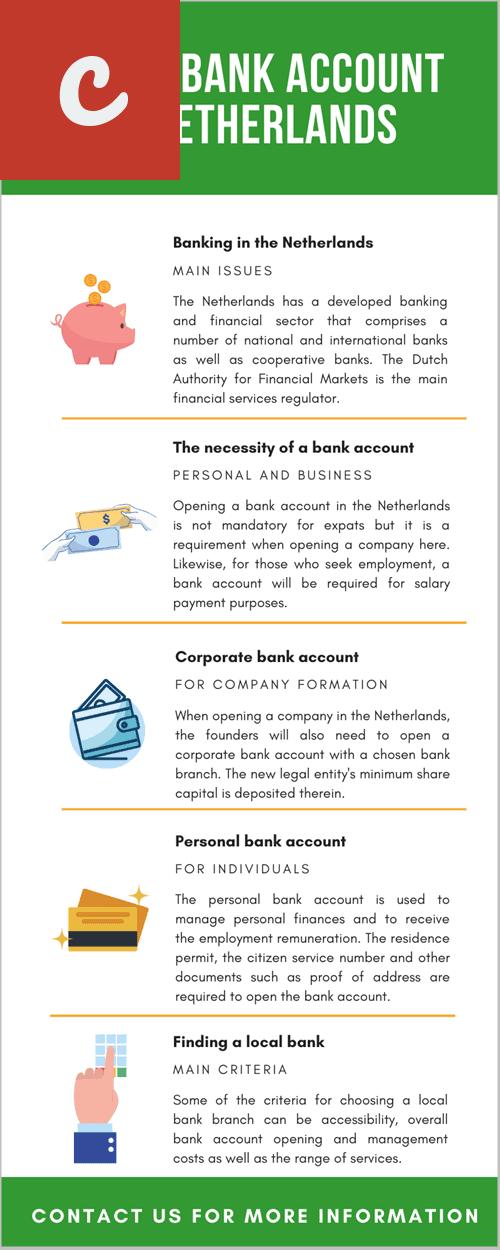

Begin by doing some research to find the right bank for your company's needs. Consider factors such as fees, services offered, and the bank's reputation. Take your time to compare different options before making a decision.

Paragraph 2: Documentation

Gather all the necessary documentation required by the bank. This may include proof of company registration, identification documents of the company's directors and shareholders, and sometimes a business plan or financial statements. Make sure you have all the required paperwork in order.

- List item 1: Proof of company registration

- List item 2: Identification documents of directors and shareholders

Paragraph 3: Scheduling an Appointment

Contact the bank of your choice and schedule an appointment to open a company bank account. It's common practice to visit the bank in person during this process. Use this opportunity to ask any questions you may have and to clarify the bank's requirements.

Paragraph 4: Visit the Bank

On the scheduled date, go to the bank with all the required documents. During the meeting, the bank will verify your documents and may ask additional questions about your business and its financial activities. This is a chance for them to assess the level of risk associated with your company. Be prepared to provide clear and detailed answers.

Paragraph 5: Banking Services and Fees

Discuss the banking services and fees with the bank representative. Make sure to understand the charges associated with maintaining the account, transaction fees, and any other costs that may be applicable. This will help you make an informed decision about the bank that best suits your business needs.

Paragraph 6: Sign the Necessary Agreements

If everything goes smoothly, the bank will provide you with all the necessary paperwork to sign. Read through all the documents carefully and make sure you understand the terms and conditions. Consider seeking legal advice if needed. Once you are satisfied, sign the agreements and complete the account opening process.

Paragraph 7: Activate Your Account

After signing the agreements, the bank will activate your company bank account. They will provide you with the account details and any other information you may need to start using the account. Make sure to set up any required online banking services and familiarize yourself with the account features.

Paragraph 8: Final Thoughts

Opening a company bank account in the Netherlands may seem like a daunting task, but following these steps will guide you through the process. Remember to do your homework, gather the required documentation, and be prepared for the bank's due diligence. With a separate business bank account, you can streamline your financial operations and position your company for success.

Main Title: The Process of Opening a Bank Account for Your Company in the Netherlands

Are you thinking about setting up a company in the Netherlands? Opening a bank account is one of the first steps you'll need to take. Having a local bank account is crucial for your business's financial operations, as it allows you to receive payments, make transactions, and manage your funds efficiently. Here's a step-by-step guide on how to open a bank account for your company in the Netherlands.

Before diving into the process, it's important to note that each bank in the Netherlands may have slightly different requirements and procedures. However, the general process follows the same principles across major banks in the country.

- List item 1: Do your research and choose the right bank

- List item 2: Gather your documents

Paragraph 3: Once you've decided on the bank, you'll need to gather the necessary documents to open the account. The typical document requirements include:

- List item 1: Certified copy of your company's articles of association

- List item 2: Extract from the Chamber of Commerce registry

- List item 3: Identification documents of your company's directors and authorized signatories

- List item 4: Proof of address for the company and its directors

- List item 5: Your company's financial statements or business plan

Paragraph 4: Prepare for a meeting with the bank

Now that you have the necessary documents, it's time to schedule a meeting with the bank. During this meeting, you'll discuss your company's needs and provide the required documents. It's advisable to prepare a business plan that showcases your company's goals, operations, and financial projections. This will help the bank understand your business and tailor their services to your needs.

Paragraph 5: Complete the application process

After submitting your documents, the bank will review your application. This process usually takes a few days to a few weeks, depending on the bank's internal procedures. Once your application is approved, you'll receive your company's bank account details.

Paragraph 6: Start managing your account

Once you have your bank account, you can start managing it to meet your company's financial requirements. Most banks in the Netherlands provide online banking services, allowing you to make transactions, monitor balances, and set up automatic payments.

In conclusion, opening a bank account for your company in the Netherlands is a crucial step in establishing your business's financial presence. By choosing the right bank, gathering the necessary documents, and following the application process, you can ensure a smooth and efficient account opening experience. Take the time to research different banks and their requirements to find the best fit for your company's needs.

Essential Tips for Setting Up a Business Bank Account in the Netherlands

Are you planning to start a business in the Netherlands? One of the most important steps you need to take is setting up a business bank account. A separate business account is not only useful for legal and financial reasons, but it also helps you keep your personal and business finances separate. Here are some essential tips to follow when setting up a business bank account in the Netherlands.

- Choose the right bank: Selecting the right banking partner is crucial for your business. The Netherlands has multiple banks, each with its own range of services and fees. It's important to do your research and compare the different options. Consider factors such as fees, account management tools, and additional services offered to make an informed decision.

- Gather the necessary documents: To open a business bank account in the Netherlands, you will need specific documents. These typically include your business registration number (KvK number), identification documents of the company directors, proof of address, and a business plan. Make sure you have all the required paperwork in order to expedite the account opening process.

- Consult with a financial advisor or accountant: It can be valuable to seek the advice of a financial advisor or accountant who is familiar with the Dutch banking system. They can guide you on the best banking options for your specific business needs and help you navigate any complex financial matters.

- Consider online banking: Many banks in the Netherlands offer online banking services, which can be convenient for managing your business finances. Online banking allows you to access your account, make transfers, and monitor transactions from anywhere. It's important to ensure that the online banking platform is secure and meets your business requirements.

- Understand banking fees: When setting up a business bank account, it's crucial to be aware of the associated fees. Some common fees include account maintenance fees, transaction fees, and fees for additional services such as international transfers. Be sure to understand the fee structure of the bank you choose and factor it into your business financial planning.

- Consider additional services: Depending on the nature of your business, you may require additional banking services. These can include features like merchant services, credit card processing, or foreign currency exchange. Assess your business requirements and determine if your chosen bank offers these services.

Setting up a business bank account in the Netherlands is an important step for any entrepreneur. By choosing the right bank, collecting the necessary documents, consulting with professionals, considering online banking, understanding fees, and assessing additional services, you can ensure a smooth and efficient process. Take the time to research your options and make an informed decision that best serves your business needs.

Main Title

When it comes to setting up a company in the Netherlands, one of the first steps you need to take is opening a bank account. A business bank account is essential for your day-to-day financial operations, such as receiving payments from clients, paying suppliers, and managing your company's finances.

Opening a company bank account in the Netherlands can sometimes be a complex process, especially if you are not familiar with the Dutch banking system. However, with the right guidance and understanding of the requirements, you can navigate through the process smoothly.

- List item 1: Research the different banks in the Netherlands - Before choosing a bank, it is important to do some research and compare the offerings of different banks. Look into the services they provide, such as online banking options, fees, and customer support.

- List item 2: Identify the requirements - Each bank has specific requirements you need to fulfill in order to open a business bank account. Typically, you will need to provide documents such as your company's articles of incorporation, proof of identification for the company's directors, and proof of address for the company's registered office.

Once you have chosen a bank and gathered all the necessary documents, the next step is to contact the bank and schedule an appointment. Meeting a representative in person can be beneficial as they can guide you through the application process and answer any questions you may have.

Opening a business bank account in the Netherlands is an important step for your company's success. By following the necessary steps and requirements, you can ensure that your financial operations run smoothly and efficiently.

If you are unsure about the process or find it overwhelming, consider seeking assistance from a professional, such as an accountant, who is familiar with the Dutch banking system and can help you navigate through the complexities.

Remember, having a business bank account not only provides you with a convenient way to manage your finances but also adds credibility to your company when dealing with clients and suppliers. It is an essential tool for the smooth functioning and growth of your business in the Netherlands.

Key Considerations When Opening a Company Bank Account in the Netherlands

Are you planning to open a company in the Netherlands? Congratulations! The Netherlands is known for its business-friendly environment and robust economy, making it an attractive destination for entrepreneurs. One key aspect of starting a company in the Netherlands is opening a company bank account. In this article, we will discuss the key considerations you should keep in mind when opening a company bank account in the Netherlands.

1. Research and Compare Different Bank Options

The first step in opening a company bank account in the Netherlands is to research and compare different bank options. The Netherlands has various banks catering to businesses, both local and international. Consider factors such as fees, services offered, online banking facilities, and reputation before making a decision. It's also a good idea to read reviews and ask for recommendations from other business owners.

2. Understand the Documentation Requirements

When opening a company bank account in the Netherlands, you will need to provide certain documentation. This typically includes:

- Proof of identification for all company directors and shareholders

- Proof of residence for all company directors and shareholders

- Certificate of incorporation for your company

- Company's articles of association

- Business plan and financial projections

- Proof of address for the company

Make sure you have all the necessary documents ready to streamline the account opening process.

3. Consider the Bank's Fees and Charges

Before finalizing a bank for your company, carefully review the fees and charges associated with the account. Banks in the Netherlands may charge various fees, such as monthly maintenance fees, transaction fees, and international transfer fees. It's important to evaluate these fees and ensure they align with your company's financial capabilities and the expected banking transactions.

4. Assess the Online Banking Features

In today's digital age, online banking features are crucial for efficient business transactions. When opening a company bank account, consider the online banking platform offered by the bank. Look for features such as ease of use, user-friendly interfaces, and access to essential services like balance inquiries, fund transfers, and payment processing. An intuitive and reliable online banking system can save you time and streamline your financial operations.

5. Seek Professional Assistance

Opening a company bank account in the Netherlands can be complex, especially for international entrepreneurs. Consider seeking professional assistance from a local accountant or business consultant who can guide you through the process. They can help you choose the right bank, compile the necessary documentation, and navigate any legal and administrative requirements.

Conclusion

Opening a company bank account in the Netherlands is a critical step for any entrepreneur starting a business in the country. By researching and comparing different bank options, understanding the documentation requirements, considering fees and charges, assessing online banking features, and seeking professional assistance, you can make an informed decision and ensure a smooth account opening process. Take the time to find the right bank that meets your company's needs, and you'll be on your way to a successful business venture in the Netherlands.

Comments on "How To Open A Bank Account For Your Company In The Netherlands"

No comment found!