Setting Up a Company in the Netherlands: A Complete Guide

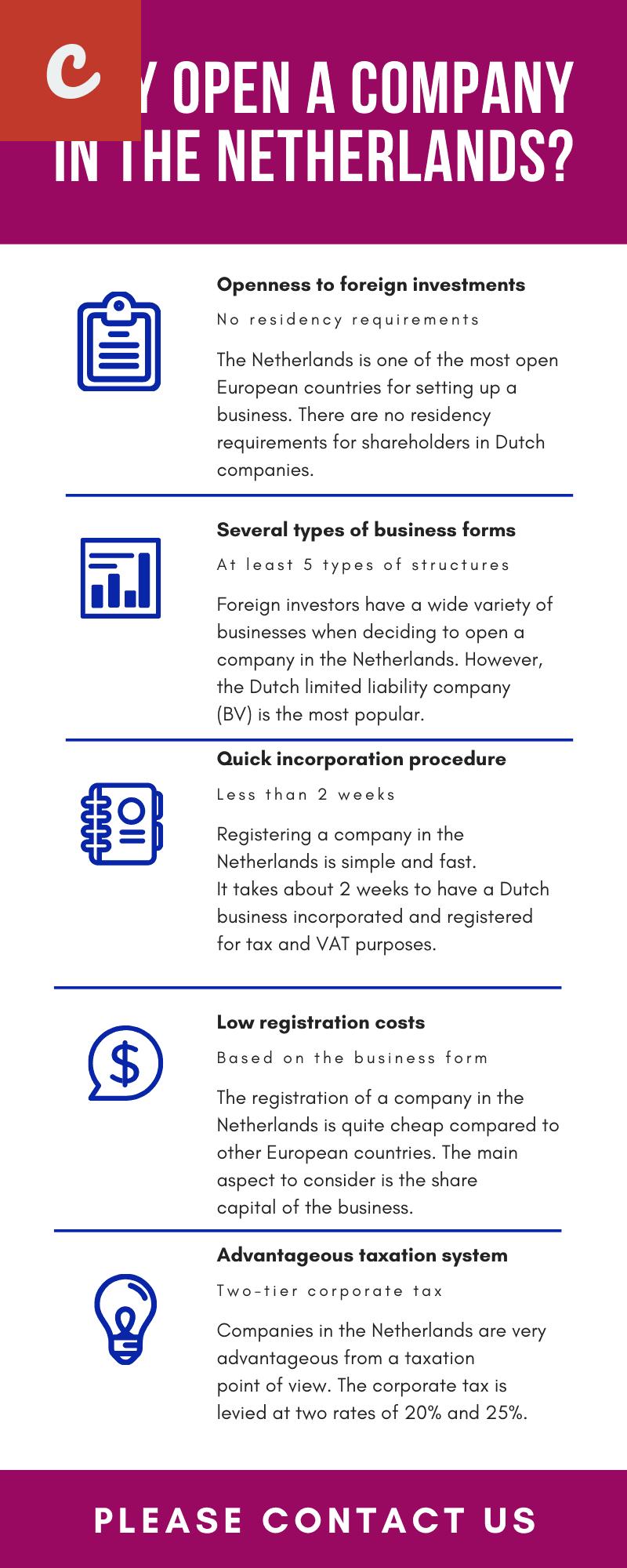

Are you considering starting a business in the Netherlands? With its favorable tax system, strategic location, and highly skilled workforce, the Netherlands is a popular choice for entrepreneurs looking to establish their company. This guide will take you through the steps to set up a company in the Netherlands, helping you navigate the process with ease.

First and foremost, it is important to determine the legal structure of your company. The most common forms of businesses in the Netherlands include sole proprietorship, partnership, private limited liability company (BV), and public limited liability company (NV).

- Sole Proprietorship: This is the simplest form of business structure, suitable for individuals who want to run a business on their own. As a sole proprietor, you have full control over your business but are personally liable for any debts.

- Partnership: A partnership involves two or more individuals who agree to run a business together. Each partner contributes capital and shares the profits and liabilities.

- Private Limited Liability Company (BV): A BV is a separate legal entity from its shareholders. It offers limited liability to its owners, meaning their personal assets are generally protected in case of bankruptcy.

- Public Limited Liability Company (NV): An NV is similar to a BV, but can have shares traded on a stock exchange. It is subject to stricter regulations and requirements.

Once you have decided on the legal structure, follow these steps to set up your company:

1. Choose a Company Name

The first step is to choose a unique name for your company. Ensure that the name is not already in use by another company and that it complies with the Dutch naming regulations.

2. Register with the Dutch Chamber of Commerce

All businesses in the Netherlands must be registered with the Dutch Chamber of Commerce (Kamer van Koophandel or KvK). You will need to provide the necessary documents and pay the registration fee.

3. Obtain a Dutch Tax Identification Number

To conduct business and hire employees in the Netherlands, you will need to obtain a Dutch Tax Identification Number (BSN or Burger Service Nummer). This number is essential for tax purposes and administration.

4. Open a Business Bank Account

It is crucial to have a separate business bank account for your company's financial transactions. Choose a reputable bank in the Netherlands and provide the necessary documents to open the account.

5. Meet Legal and Financial Requirements

Ensure that your company complies with all legal and financial requirements. This includes drafting articles of association, appointing directors, and meeting capital requirements if applicable.

6. Register for Taxes

Depending on the nature of your business, you may need to register for various taxes such as Value Added Tax (VAT) and corporate income tax. Familiarize yourself with the Dutch tax system or seek professional advice to meet your tax obligations.

7. Fulfill Employer Obligations (if applicable)

If you plan to hire employees, you must fulfill certain obligations as an employer. This includes registering with the Dutch Tax and Customs Administration and providing the necessary employee benefits.

By following these steps, you will be well on your way to setting up a successful company in the Netherlands. Remember to consult with legal and financial professionals to ensure compliance with all regulations. Good luck with your new venture!

Setting Up a Company in the Netherlands: A Step-by-Step Guide

If you are considering expanding your business to the Netherlands, you may be wondering how to set up a company in this entrepreneurial hub. This step-by-step guide will walk you through the process and help you navigate the Dutch business landscape.

Step 1: Research

The first step in setting up a company in the Netherlands is to conduct thorough research. Familiarize yourself with the Dutch business environment, market conditions, and legal requirements. This will help you make informed decisions throughout the process.

Step 2: Choose the Right Legal Structure

The next step is to decide on the legal structure for your company. The most common options in the Netherlands are sole proprietorship, partnership, private limited company (BV), and public limited company (NV). Each structure has its own advantages and disadvantages, so it is important to choose the one that best suits your needs.

Step 3: Register at the Chamber of Commerce

Once you have chosen a legal structure, you need to register your company at the Dutch Chamber of Commerce (Kamer van Koophandel or KvK). This can be done online or in person. You will need to provide information about your company, such as its name, legal structure, and business activities.

- List item 1: Prepare the necessary documents, including identification documents, proof of address, and a business plan.

- List item 2: Pay the registration fee, which varies depending on the legal structure of your company.

Step 4: Obtain a Business Bank Account

To operate your company in the Netherlands, you will need a Dutch business bank account. Choose a bank that meets your business needs and provides the services you require, such as online banking and international money transfers. The bank will require certain documents from you, such as your Chamber of Commerce registration confirmation.

Step 5: Comply with Tax Obligations

As a business owner in the Netherlands, you are required to comply with tax obligations. This includes registering for VAT (Value-Added Tax) and obtaining a tax number. Familiarize yourself with the Dutch tax system and consult with a tax advisor if necessary.

Step 6: Arrange for Insurance

Insurance is an important aspect of running a business. In the Netherlands, you are legally required to have certain types of insurance, such as employee insurance (if applicable). Additionally, consider other types of insurance to protect your business against potential risks and liabilities.

Step 7: Hire Employees (if applicable)

If your company requires employees, you will need to familiarize yourself with Dutch employment law and hire qualified individuals. Ensure that you comply with employment contracts, minimum wage regulations, and other legal requirements.

Step 8: Establish a Presence

Now that your company is set up, it's time to establish a physical or virtual presence in the Netherlands. This may involve setting up an office or store, creating a website, and marketing your products or services to the Dutch market.

Congratulations! You have successfully set up your company in the Netherlands. Remember to stay updated on legal and regulatory changes that may affect your business and seek professional advice when needed.

The Ultimate Checklist for Setting Up a Company in the Netherlands

Setting up a company in the Netherlands can be a lucrative endeavor, thanks to its favorable business climate and strategic location within Europe. However, like any other country, there are certain legal and administrative procedures that need to be followed. To ensure a smooth and hassle-free process, here's a checklist to guide you:

- Choose the right legal entity: When setting up a company in the Netherlands, you need to choose the appropriate legal entity. The options include a private limited liability company (BV), partnership, sole proprietorship, or a branch office.

- Create a business plan: A well-thought-out business plan is essential for success. It should outline your mission, target market, competition analysis, financial projections, and marketing strategies.

- Register with the Trade Register: Every company in the Netherlands must be registered with the Dutch Chamber of Commerce (KVK). This includes providing details about your company's structure, address, and activities.

- Appoint a legal representative: If you are residing outside of the Netherlands, it is mandatory to appoint a legal representative who can act on behalf of your company locally.

- Open a business bank account: To separate your personal finances from your business finances, it is advisable to open a business bank account. This will make accounting and tax filings easier.

- Obtain necessary permits and licenses: Depending on your industry, you might need specific permits or licenses to operate legally. Research and obtain these permits before commencing operations.

Register with the Tax Administration: All companies in the Netherlands are required to register with the Tax Administration (Belastingdienst). You will be assigned a VAT number and must adhere to relevant tax regulations.

Set up proper bookkeeping and accounting: The Dutch Tax Administration has specific requirements for bookkeeping and accounting. Ensure that you maintain accurate financial records and comply with local regulations.

Insure your business: Protect your business by obtaining the right insurance coverage. This may include liability insurance, property insurance, employee insurance, and others.

Hire staff if needed: If your business requires employees, make sure you understand employment laws and regulations. Establish clear employment contracts and adhere to minimum wage laws.

Stay compliant with legal and regulatory requirements: Familiarize yourself with the local labor laws, tax regulations, and any other legal requirements that apply to your business. Engage legal and accounting professionals to ensure compliance.

By following this checklist, you can set up your company in the Netherlands with ease and confidence. Remember to seek professional advice when needed, as the regulations and requirements may vary depending on the nature of your business. Good luck with your new venture!

Key Tips for Successfully Establishing a Company in the Netherlands

Establishing a company in the Netherlands can be an exciting venture. With its favorable business environment, strategic location in Europe, and highly skilled workforce, the Netherlands offers great opportunities for entrepreneurs. However, starting a company in a foreign country can also be challenging. Here are some key tips to help you successfully establish your company in the Netherlands:

- Do thorough research: Before setting up your company, it's important to thoroughly research the Dutch market and understand the legal, cultural, and economic aspects of doing business in the Netherlands. This will help you make informed decisions and avoid potential pitfalls.

- Choose the right legal structure: The Netherlands offers several types of legal structures for businesses, such as sole proprietorship, partnership, and private limited company (BV). Each structure has its own advantages and disadvantages, so it's crucial to choose the one that best fits your needs and long-term goals.

- Register your company: To officially establish your company in the Netherlands, you need to register it with the Dutch Chamber of Commerce (KVK). The registration process involves providing necessary documents, such as identification proof, business plan, and proof of address. It's advisable to seek legal assistance to ensure a smooth registration process.

- Understand the tax system: Familiarize yourself with the Dutch tax system and its implications for your business. The Netherlands has a favorable tax climate with various tax incentives and benefits for businesses. However, it's essential to comply with the tax regulations and meet your obligations to avoid any legal issues.

- Networking is key: Building a strong network in the Netherlands is crucial for the success of your business. Attend industry events, join business associations, and connect with local entrepreneurs and professionals. Networking not only helps you establish valuable connections but also provides you with insights into the local business landscape.

- Hire local expertise: To navigate the Dutch business environment effectively, consider hiring local expertise. Local professionals, such as accountants, lawyers, and consultants, can provide valuable advice and support, especially when it comes to legal and regulatory matters.

- Embrace the multilingual culture: English is widely spoken in the Netherlands, but learning Dutch can be beneficial when doing business in the country. Embracing the multilingual culture not only facilitates communication with local clients and partners but also demonstrates your commitment to integrating into the Dutch society.

In conclusion, establishing a company in the Netherlands can be a rewarding endeavor with proper planning and execution. By conducting thorough research, choosing the right legal structure, and seeking local expertise, you can set yourself up for success in the Dutch market. Embrace the opportunities that the Netherlands offers and make the best use of its favorable business environment to achieve your entrepreneurial goals.

Setting Up a Company in the Netherlands

If you are looking to set up a company in the Netherlands, it is crucial to understand the legal process involved. This article will guide you through the necessary steps to establish your business successfully.

Before diving into the details, it's essential to have a clear understanding of the type of company you want to establish. The Netherlands offers several options, including sole proprietorship, partnership, private limited company (BV), and public limited company (NV). Each has its benefits and legal requirements, so it's crucial to choose the right structure for your business.

- 1. Determine the legal structure

Once you have decided on the legal structure that suits your business best, it's time to begin the formal process. The first step is to gather all the necessary information and documents required to register your company. This includes proof of identity, a business plan, and additional supporting documents, depending on the chosen legal structure.

- 2. Register with the Chamber of Commerce

Registering your company with the Chamber of Commerce (KVK) is mandatory. It is a straightforward process that can be done online or in person. You will need to provide all the required documents and pay the registration fee. Once your registration is complete, you will receive a registration number which is essential for conducting business in the Netherlands.

- 3. Obtain necessary permits and licenses

Depending on the nature of your business, you may need to obtain additional permits and licenses. The Netherlands has specific regulations for various industries, such as healthcare, finance, and food services. Research thoroughly to ensure you comply with all applicable rules and regulations.

- 4. Fulfill tax obligations

As a business owner in the Netherlands, you are required to fulfill various tax obligations. This includes registering for VAT (Value Added Tax), income tax, and corporate tax. Familiarize yourself with the Dutch tax system or seek the assistance of a tax advisor to ensure compliance.

- 5. Open a business bank account

Opening a business bank account is essential to separate your personal and business finances. This will help you track your company's financial transactions and simplify bookkeeping. Research different banks to find the best fit for your business needs.

Setting up a company in the Netherlands might seem complex, but with the right guidance, it can be a smooth process. Take the time to research the legal requirements, gather all necessary documentation, and seek professional advice when needed. By taking these steps, you can establish your business successfully and navigate the Dutch legal system with confidence.

Comments on "How To Set Up A Company In The Netherlands"

No comment found!