Steps to Launching Your Business in the Netherlands

Starting a business is an exciting endeavor, but it can also be challenging, especially if you are looking to expand your operations to a new country. If you are considering launching your business in the Netherlands, it's important to understand the necessary steps to ensure a smooth and successful process. Here are the key steps to follow:

1. Research the market: Before setting up your business in the Netherlands, it is essential to conduct thorough market research. Identify your target audience, competitors, and industry trends to gain a comprehensive understanding of the market you are entering.

2. Develop a business plan: Create a solid business plan that outlines your goals, marketing strategy, and financial projections. This plan will serve as a roadmap for your business and will help you stay focused and make informed decisions as you launch and grow your operations.

3. Choose a business structure: Decide on the legal structure of your business. Common options in the Netherlands include sole proprietorship, partnership, private limited company (BV), and public limited company (NV). Each structure has different requirements and implications, so it is advisable to consult with a legal professional to determine the best fit for your business.

- List item 1: If you choose to register as a sole proprietorship, you will have full control and responsibility for your business. However, you will also be personally liable for its debts.

- List item 2: A private limited company (BV) is a popular choice for entrepreneurs, as it provides limited liability protection to shareholders and allows for easy transfer of ownership.

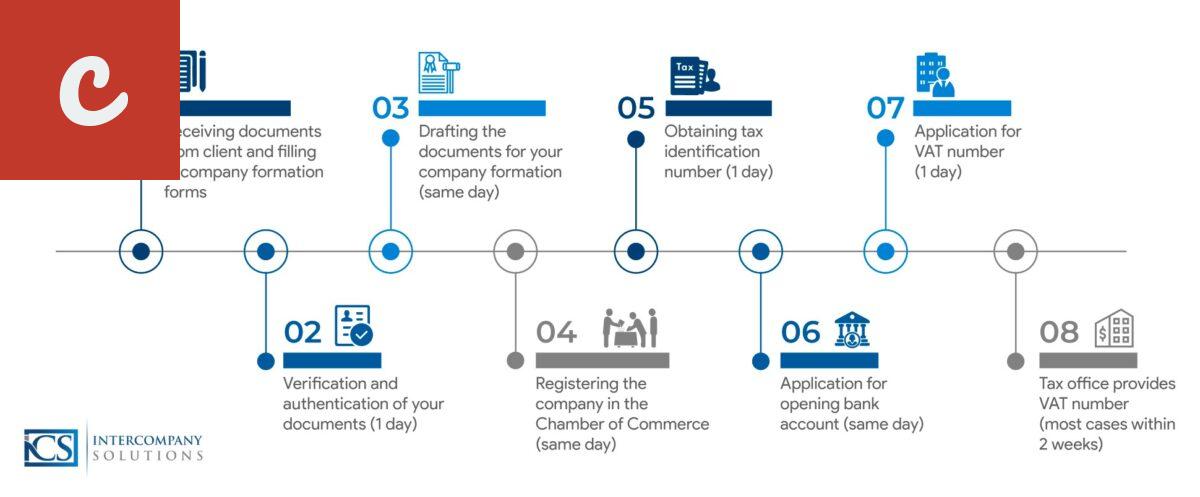

4. Register your business: To legally operate in the Netherlands, you must register your business with the Dutch Commercial Register at the Chamber of Commerce (KVK). You will need to provide various documents, including identification, business plan, and proof of address. The registration process can typically be completed online.

5. Determine your tax obligations: Familiarize yourself with the Dutch tax system and determine your tax obligations. The Netherlands has a progressive tax system, and it is important to understand your responsibilities regarding corporate income tax, value-added tax (VAT), payroll taxes, and any other applicable taxes. Consider working with a tax advisor who specializes in international taxation to ensure compliance.

6. Arrange necessary permits and licenses: Depending on your business activities, you may need to obtain specific permits or licenses. For example, if you plan to open a restaurant, you will need to apply for a food and beverage license. Research the requirements for your particular business sector and ensure that you comply with all regulations.

7. Set up financial and administrative processes: Establish efficient financial and administrative processes from the beginning. This includes setting up a business bank account, keeping accurate records, and understanding your reporting obligations to the tax authorities.

8. Hire employees or subcontractors: If your business requires additional staff, it is crucial to understand Dutch employment laws and regulations. Familiarize yourself with employment contracts, minimum wage requirements, and any other legal obligations you need to fulfill as an employer. Consider seeking guidance from a local HR professional to ensure compliance.

9. Market your business: Once set up, it's time to market your business and attract customers. Utilize online and offline marketing strategies to raise awareness about your products or services. Building a strong online presence through social media and a professional website can help you reach a wider audience.

By following these steps and seeking professional advice when needed, you can successfully launch your business in the Netherlands. Remember to stay adaptable and open to learning as you navigate the Dutch business landscape.

Main Title: A Guide to Setting Up a Business in the Netherlands

Are you considering starting a business in the Netherlands? The country has a thriving economy and an entrepreneurial culture that attracts many aspiring entrepreneurs. This guide will provide you with essential information on how to set up your business in the Netherlands successfully.

Before you begin the process of setting up your business in the Netherlands, it is important to understand the legal requirements. One of the first steps is to register your business with the Dutch Chamber of Commerce (KvK). This registration is mandatory and will give your business a unique identification number known as the KvK number.

- List item 1: Choosing the right legal structure

When setting up a business in the Netherlands, you have several legal structures to choose from, such as a sole proprietorship, partnership, private limited company (BV), or a public limited company (NV). Each structure has its own advantages and disadvantages, so it is important to consider your business goals, liability, and tax implications.

- List item 2: Opening a bank account

Once you have registered your business, you will need to open a business bank account in the Netherlands. Having a separate bank account for your business is crucial for financial transparency and ease of managing your finances. It is advisable to research different banks and compare their services and fees before making a decision.

Having a solid business plan is essential for the success of your business. It will outline your goals, target market, competition, pricing strategies, and financial projections. A well-defined business plan is not only necessary for your own clarity but also valuable when seeking funding or attracting potential investors.

Another important factor to consider is the tax obligations for your business in the Netherlands. The Dutch tax system can be complex, so consulting with a tax advisor or accountant is highly recommended. They can guide you through the process, help you understand your tax obligations, and ensure compliance with the Dutch tax authorities.

Additionally, it is crucial to understand the labor market in the Netherlands if you plan to hire employees for your business. Familiarize yourself with the employment laws, workers' rights, and obligations as an employer. It is also worth considering the various incentives and subsidies that the Dutch government offers to businesses to promote job creation.

In conclusion, setting up a business in the Netherlands can be a rewarding venture. By understanding the legal requirements, choosing the right legal structure, opening a business bank account, creating a comprehensive business plan, navigating the tax obligations, and understanding the labor market, you can set yourself up for success in the Dutch business landscape.

Essential Tips for Starting a Business in the Netherlands

Starting a business can be an exciting and rewarding venture. However, it can also be overwhelming, especially if you are starting in a foreign country. The Netherlands is a popular destination for entrepreneurs due to its vibrant economy and supportive business environment. If you are considering starting a business in the Netherlands, here are some essential tips to help you get started.

1. Conduct thorough market research: Before starting any business, it is crucial to understand the market you are entering. Research your target audience, competitors, and local regulations to ensure there is a demand for your product or service. Identify any gaps in the market that you can fill with your business.

- List item 1: Identify your business structure: The most common types of business structures in the Netherlands are sole proprietorship (eenmanszaak), partnership (vennootschap onder firma), and private limited company (besloten vennootschap). Choose the structure that best suits your needs and consult an expert to understand the legal and tax implications.

- List item 2: Register your business: To formalize your business, you need to register it with the Dutch Chamber of Commerce (Kamer van Koophandel). You will receive a unique Chamber of Commerce number (KvK number), which is necessary for conducting business in the Netherlands.

3. Create a comprehensive business plan: A solid business plan is essential for attracting investors and securing financing. It should outline your business goals, target market, marketing strategy, financial projections, and any legal requirements. A well-written business plan will also guide you through the early stages of your business.

4. Seek professional advice: Consult with experts such as accountants, tax advisors, and legal professionals who specialize in Dutch business law. They can help you navigate the complexities of the Dutch legal and tax systems, ensuring compliance and maximizing your business's potential.

5. Learn Dutch: While many people in the Netherlands speak English, knowing Dutch will give you a competitive advantage. It will allow you to better communicate with local suppliers, clients, and authorities. Consider taking language lessons or hiring a language tutor to improve your Dutch language skills.

6. Familiarize yourself with the local culture and business practices: The Netherlands has a unique business culture, and understanding it can greatly benefit your business. Networking is important, so join local business associations and attend industry events. Take the time to build relationships with potential clients, partners, and local professionals.

7. Obtain necessary permits and licenses: Depending on your business activities, you may need specific permits and licenses to operate legally in the Netherlands. Research the requirements and obtain the necessary documentation to avoid any legal issues in the future.

8. Build a professional network: Networking is crucial for business success in the Netherlands. Attend trade shows, conferences, and local business meetings to connect with potential clients, suppliers, and partners. Join industry-specific organizations and online forums to expand your network and stay updated on industry trends.

Conclusion: Starting a business in the Netherlands can be a rewarding endeavor with the right preparation and guidance. Conduct thorough market research, choose the appropriate business structure, register your business, and create a comprehensive business plan. Seek professional advice and familiarize yourself with the local culture and business practices. Obtaining necessary permits and licenses, learning Dutch, and building a professional network will further contribute to your success in the Netherlands.

Starting a Business in the Netherlands

Are you thinking about starting your own business in the Netherlands? With its favorable business climate and entrepreneurial spirit, the Netherlands is a great place to get your business up and running. In this article, we will guide you through the complete process of starting a business in the Netherlands.

Before you dive into the business world, it's essential to conduct thorough research and develop a solid business plan. This initial step will help you define your target market, analyze your competitors, and outline your financial projections.

- Register your business: The first step in starting a business in the Netherlands is to register your company with the Dutch Chamber of Commerce (Kamer van Koophandel or KvK). You will need to provide them with all the necessary documents, such as identification, proof of address, and company details.

- Choose a legal structure: The Netherlands offers various legal forms for businesses, including a sole proprietorship, partnership, limited liability company (BV), and cooperative. Each legal structure has its own advantages and disadvantages, so it's important to consider your specific needs and consult with a legal professional.

- Apply for necessary permits: Depending on the nature of your business, you may need specific licenses or permits to operate legally. For example, if you plan to start a restaurant, you will need a food handling permit. Research and ensure that you comply with all the relevant regulations.

- Business insurance: It's advisable to obtain business insurance to protect your company from unexpected events or liabilities. Common types of business insurance in the Netherlands include liability insurance, property insurance, and professional indemnity insurance.

- Bank account: Open a business bank account to separate your personal and business finances. This will help you maintain transparent and organized financial records necessary for taxation and financial reporting.

Now that you have completed the legal and administrative tasks, it's time to focus on the operational aspects of your business.

Marketing and branding: Develop a marketing strategy to promote your business and attract customers. Create a strong brand identity through a professional logo, website, and social media presence. Utilize various marketing channels to reach your target audience.

Hiring employees: If your business requires additional manpower, you need to familiarize yourself with Dutch employment laws and register with the Dutch Tax and Customs Administration (Belastingdienst) as an employer. Ensure that you comply with labor regulations, such as minimum wage requirements and employment contracts.

Financial management: Maintain accurate financial records and consider hiring a professional accountant to help you with bookkeeping, tax filings, and financial statements. Familiarize yourself with the Dutch tax system and ensure timely payment of taxes.

Networking and support: Join business networks and associations to connect with like-minded entrepreneurs and gain valuable insights. The Netherlands has a vibrant startup ecosystem, and there are various support organizations and resources available to assist you in your entrepreneurial journey.

In conclusion, starting a business in the Netherlands involves several crucial steps, including business registration, choosing a legal structure, obtaining the necessary permits, and developing a robust marketing strategy. Remember to seek professional advice and leverage the available support networks to enhance your chances of success. Good luck with your new business venture!

Key Requirements for Establishing Your Business in the Netherlands

If you're considering establishing a business in the Netherlands, it is important to understand the key requirements and regulations to ensure a smooth and successful process. The Netherlands is known for its business-friendly environment, making it an attractive destination for entrepreneurs and companies looking to expand their operations.

Here are the key requirements you should be aware of:

- Business Plan: One of the first steps is to create a comprehensive business plan that outlines your objectives, target market, financial projections, and marketing strategies. A well-prepared business plan is essential for obtaining financing and demonstrating your commitment to the success of your venture.

- Legal Structure: Choose the appropriate legal structure for your business. The most common options in the Netherlands include a sole proprietorship (eenmanszaak), a partnership (vennootschap onder firma), a private limited liability company (besloten vennootschap or BV), or a public limited liability company (naamloze vennootschap or NV). Each structure has its own benefits and considerations, so it is wise to consult with a legal advisor to determine the best fit for your business.

- Registration: To establish your business in the Netherlands, you'll need to register with the Dutch Commercial Register (Handelsregister) kept by the Chamber of Commerce (Kamer van Koophandel or KvK). This registration ensures that your business is legally recognized and allows you to obtain a unique business identification number (KvK number).

- Taxes: Familiarize yourself with the Dutch tax system and its obligations. You will need to obtain a tax identification number (Burgerservicenummer or BSN) and register with the tax authority (Belastingdienst) for corporate tax purposes. Additionally, you'll need to comply with VAT (Value Added Tax) regulations if your annual turnover exceeds a certain threshold.

- Permits and Licenses: Depending on the nature of your business, you may require specific permits or licenses to operate legally in the Netherlands. These can include permits for construction, hospitality, healthcare, transportation, and more. It is advisable to consult with the relevant authorities or a business consultant to ensure compliance.

- Employment Regulations: If you plan to hire employees, familiarize yourself with Dutch labor laws and regulations. These include minimum wage requirements, employment contracts, working hours, vacation allowances, and social security contributions. Compliance with these regulations is crucial to maintaining a fair and lawful work environment.

Establishing a business in the Netherlands can be a rewarding venture with the right preparation and knowledge of the key requirements. Use the information above as a starting point to navigate the process smoothly, and consider seeking professional advice to ensure compliance with all legal and regulatory obligations.

Comments on "How To Start A Business In The Netherlands"

No comment found!