Important Factors to Consider for Foreign Investors when Forming a Company in the Netherlands

Are you a foreign investor looking to set up a company in the Netherlands? Congratulations on your decision! The Netherlands is known for its favorable business environment, strong infrastructure, and strategic location. To ensure a smooth and successful business setup, it is important to consider several factors. Let's explore some of the key aspects you need to keep in mind.

1. Business Structure: The first step is to decide on the type of business structure that suits your requirements. The common forms of business entities in the Netherlands include a sole proprietorship, partnership, private limited liability company (BV), and public limited liability company (NV). Each structure comes with its own legal and financial implications, so it is crucial to choose the one that aligns with your business objectives.

2. Local Regulations and Laws: Familiarize yourself with the local regulations and laws that govern businesses in the Netherlands. It is highly recommended to consult with a legal advisor or a professional agency specializing in company formation to ensure compliance and understand the legal obligations you need to meet.

3. Taxation: Understanding the Dutch tax system is key when setting up a company in the Netherlands. The country has various tax incentives and a favorable corporate tax regime, making it an attractive destination for foreign investors. However, it is essential to seek advice from a tax expert to navigate through the tax landscape effectively and optimize your tax liability.

- 4. Residency and Work Permits: Depending on your nationality and the nature of your business, you may need to obtain the necessary residency and work permits. The Netherlands offers different visa options for entrepreneurs, self-employed individuals, and highly skilled migrants. Research the required permits and consult with immigration specialists to ensure a smooth transition for you and your employees.

- 5. Business Support and Networking: Building a strong network and seeking business support can greatly contribute to your success as a foreign investor. The Netherlands provides a vibrant startup ecosystem, business networks, and incubators that can offer valuable resources, mentorship, and collaboration opportunities.

6. Language and Culture: While English is widely spoken in the Netherlands, it is important to understand the Dutch culture and working style. Familiarize yourself with the local etiquette, business customs, and language to establish strong relationships with clients, partners, and employees.

Forming a company in the Netherlands can be an exciting and rewarding venture for foreign investors, provided the necessary considerations are made. By carefully analyzing the business structure, legal requirements, tax implications, permits, networking opportunities, and cultural aspects, you can set a strong foundation for your company's success. Remember to seek professional guidance to navigate through the complexities and make informed decisions. Good luck with your new business venture in the Netherlands!

Crucial Considerations for Foreign Investors in Company Formation in the Netherlands

Foreign investors searching for new business opportunities often turn their attention to the Netherlands. With its strong economy, strategic location in Europe, and favorable business climate, the Netherlands offers an attractive environment for company formation. However, before establishing a company in the Netherlands, it is crucial for foreign investors to be aware of several key considerations.

One of the essential factors to consider is the legal structure of the company. The Netherlands offers various legal structures, such as a sole proprietorship, partnership, private limited liability company (BV), or public limited liability company (NV). Each structure has its own advantages and disadvantages, so it is recommended to seek legal counsel to determine the most suitable option based on your specific needs.

- Foreign investors must also consider the tax implications of establishing a company in the Netherlands. The Dutch tax system is known for its transparency and favorable business climate. However, it is crucial to understand the tax obligations and benefits of operating in the Netherlands, including corporate tax rates, VAT regulations, and any applicable tax treaties between the Netherlands and the investor's home country.

- Choosing the right location for your company is another vital consideration. The Netherlands offers several cities with strong business infrastructures, such as Amsterdam, Rotterdam, and The Hague. Each city has its own unique advantages, so it is important to evaluate factors such as accessibility, presence of talent, industry networks, and regional incentives before making a decision.

Additionally, language proficiency is an important consideration. Although the Dutch are generally proficient in English, particularly in business settings, it can be beneficial to learn the local language (Dutch) to further integrate into the work culture and establish stronger relationships with local partners and clients.

Networking is key in the Netherlands, so it is crucial for foreign investors to build strong connections within the local business community. Joining industry-specific associations, attending business events, and seeking advice from local experts can provide valuable insights and opportunities for collaboration.

Lastly, foreign investors should understand the legal and regulatory requirements for company formation in the Netherlands. This includes procedures for registering the company, acquiring necessary permits and licenses, and complying with local labor and employment laws. Consulting with experts in Dutch business law can help ensure a smooth and compliant company formation process.

In conclusion, the Netherlands presents a favorable environment for foreign investors considering company formation. However, it is crucial to consider factors such as legal structure, tax implications, location, language proficiency, networking, and legal requirements to make informed decisions and maximize the potential for success.

Essential Factors for Foreign Investors to Keep in Mind for Company Formation in the Netherlands

The Netherlands has emerged as a popular destination for foreign investors looking to establish their business presence in Europe. With its favorable business climate, robust infrastructure, and strategic geographical location, the country offers numerous opportunities for companies of all sizes and industries. However, foreign investors must navigate several essential factors when considering company formation in the Netherlands.

1. Legal Structure: Selecting the right legal structure is crucial for foreign investors. The most common options in the Netherlands are a private limited liability company (BV) or a branch office. A BV provides limited liability protection and is suitable for most types of businesses, while a branch office represents an extension of a foreign parent company.

2. Financial Considerations: Financial planning is vital during the company formation process. Foreign investors need to consider costs related to registration, legal fees, and taxes. Additionally, they must meet certain capital requirements, which vary based on the chosen legal structure.

- 3. Taxation: Understanding the Dutch tax system is essential for foreign investors. The Netherlands offers various tax incentives and favorable conditions for international businesses. It has an extensive treaty network and a competitive corporate tax rate, making it an attractive destination for foreign investors.

- 4. Business Permits and Licenses: Depending on the nature of the business, foreign investors may need specific permits or licenses to operate in the Netherlands. It is crucial to research and comply with relevant regulations to avoid potential legal issues and delays.

5. Labor Laws: Complying with Dutch labor laws is essential when hiring employees in the Netherlands. Foreign investors must be familiar with regulations related to employment contracts, termination procedures, working hours, and minimum wages.

6. Business Culture: Understanding the Dutch business culture is vital for foreign investors to build successful relationships. The Netherlands values direct communication, punctuality, and consensus-based decision-making. Networking and building connections with local professionals can greatly benefit foreign businesses.

In conclusion, foreign investors looking to establish a company in the Netherlands must consider various essential factors to ensure a smooth and successful company formation process. By carefully navigating legal structures, financial considerations, taxation, permits, labor laws, and business culture, foreign investors can position themselves for long-term success in the Dutch market.

Main Title: The Most Important Considerations for Foreign Investors in Setting up a Company in the Netherlands

Foreign investors looking to expand their business into Europe often consider setting up a company in the Netherlands. With its vibrant economy, stable political system, and favorable business environment, the Netherlands offers numerous opportunities for international entrepreneurs. However, before taking the plunge, it is crucial to understand the most important considerations for foreign investors when setting up a company in the Netherlands.

First and foremost, choosing the right legal structure is a crucial decision. The most common forms of business entities in the Netherlands are the private limited liability company (BV) and the public limited liability company (NV). The choice depends on factors such as the number of shareholders, liability implications, and the desired legal and financial structure. Consulting with a business lawyer or tax advisor is highly recommended to ensure compliance with Dutch laws and regulations.

- List item 1: Taxation

Taxation is another important consideration for foreign investors in the Netherlands. The country offers an attractive business climate with a competitive corporate tax rate of 15-25%. In addition to the corporate tax, other taxes such as value-added tax (VAT) and payroll taxes need to be taken into account. Understanding the tax regulations and potential tax benefits available to foreign investors is essential to optimize the company's financial situation.

- List item 2: Labor Force

The availability of a skilled labor force is crucial for the success of any business. Fortunately, the Netherlands has a highly educated and multilingual workforce, making it an attractive destination for foreign businesses. The country also has favorable labor laws that protect both employers and employees. It is important for foreign investors to understand local labor regulations, employment contracts, and any specific requirements for hiring foreign employees.

Furthermore, access to markets is another factor to consider. The Netherlands is known for its strategic location and excellent infrastructure, making it a gateway to the European market. With its well-established transportation network and advanced logistics system, the country provides easy access to over 500 million consumers in Europe. This can greatly benefit foreign investors seeking to expand their reach in the European Union.

Lastly, it is crucial to understand cultural differences and adapt to the Dutch business environment. Building strong relationships with local partners, clients, and suppliers is essential for success. Dutch business culture values direct communication, punctuality, and efficiency. Familiarizing oneself with Dutch customs and etiquette can help foreign investors establish a positive reputation in the local business community.

In conclusion, setting up a company in the Netherlands can offer significant advantages for foreign investors. However, it is essential to consider factors such as the legal structure, taxation, labor force, market access, and cultural differences. By thoroughly understanding these considerations and seeking professional advice, foreign investors can navigate the Dutch business landscape successfully and maximize their opportunities for growth and success.

Main Title: Key Factors to Take into Account for Foreign Investors in Company Formation in the Netherlands

Are you a foreign investor looking to expand your business in the Netherlands? Incorporating a company in a foreign country can be a challenging task, but with the right knowledge and guidance, it can become a smooth process. This article will outline the key factors that foreign investors should take into account when considering company formation in the Netherlands.

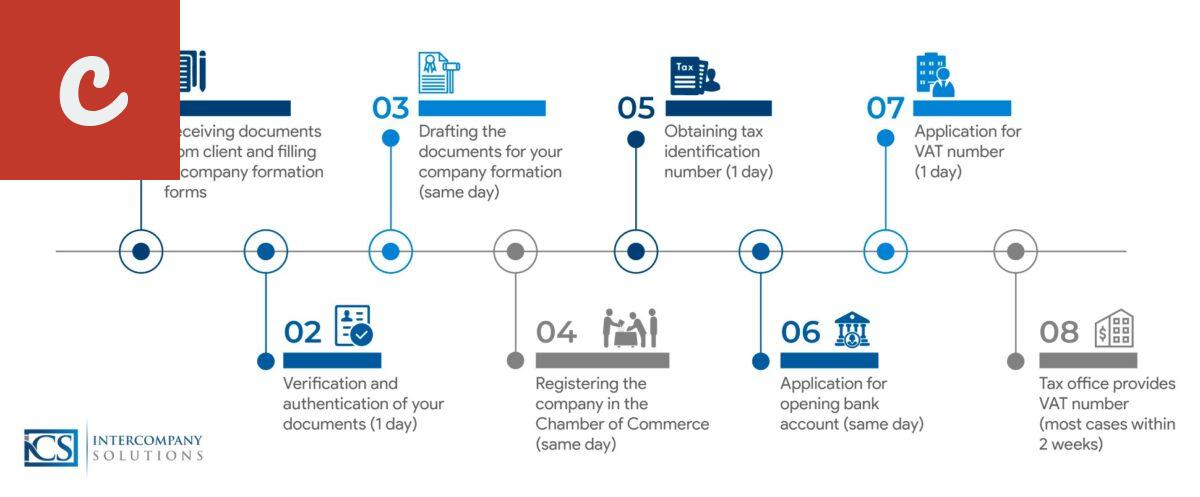

First and foremost, it is important to understand the legal requirements for company formation in the Netherlands. The Dutch legal system follows strict guidelines and regulations, so it is crucial to comply with all the necessary procedures. The process typically involves registering the company with the Dutch Chamber of Commerce, obtaining a Dutch tax number, and opening a business bank account.

One important factor to consider is the legal structure of the company. The Netherlands offers different legal entities such as a private limited company (BV), a public limited company (NV), and a branch office. Each legal structure has its own advantages and disadvantages, depending on factors such as liability, tax implications, and administrative requirements. It is advisable to seek professional advice to determine the most suitable legal structure for your business.

- List item 1: Taxation - The Netherlands has a favorable tax climate for foreign investors. The country offers various tax incentives, such as the participation exemption for qualifying dividends and capital gains, a broad network of double taxation treaties, and a competitive corporate tax rate. However, it is important to understand the local tax regulations and seek professional advice to optimize your tax position.

- List item 2: Labor market - The Netherlands has a highly skilled and productive workforce, making it an attractive location for foreign investors. The country also has flexible labor laws, which allow for easy hiring and firing of employees. It is essential to familiarize yourself with the Dutch labor market regulations and employment contracts to ensure compliance.

In addition to these key factors, foreign investors should also consider the local business culture, infrastructure, and market potential. The Netherlands is known for its open and internationally oriented business environment, making it a gateway to the European market. The country has world-class transport links, a well-developed digital infrastructure, and a strong knowledge base. Conducting thorough market research and understanding the local business customs will contribute to the success of your company formation.

In conclusion, foreign investors should carefully consider the legal requirements, tax implications, labor market regulations, and other key factors when planning company formation in the Netherlands. Seeking professional advice and conducting proper research will ensure a smooth and successful process. The Netherlands offers ample opportunities for foreign investors, and with the right preparations, your business can thrive in this vibrant European country.

Comments on "Key Factors To Consider For Foreign Investors In Company Formation In The Netherlands"

No comment found!