A Comprehensive Guide to Company Formation in the Netherlands

The Netherlands is a favorable destination for entrepreneurs looking to set up their own companies. With its stable economy, strategic location, and business-friendly policies, it offers ample opportunities for growth and success. However, understanding the process of company formation in the Netherlands is crucial to ensure a smooth and hassle-free experience.

1. Choose the Right Legal Structure: The first step in company formation is selecting an appropriate legal structure. In the Netherlands, you can opt for a sole proprietorship (eenmanszaak), a partnership (vof), a private limited liability company (bv), or a public limited liability company (nv). Each structure has its own advantages and disadvantages, so it's important to choose what aligns with your business goals.

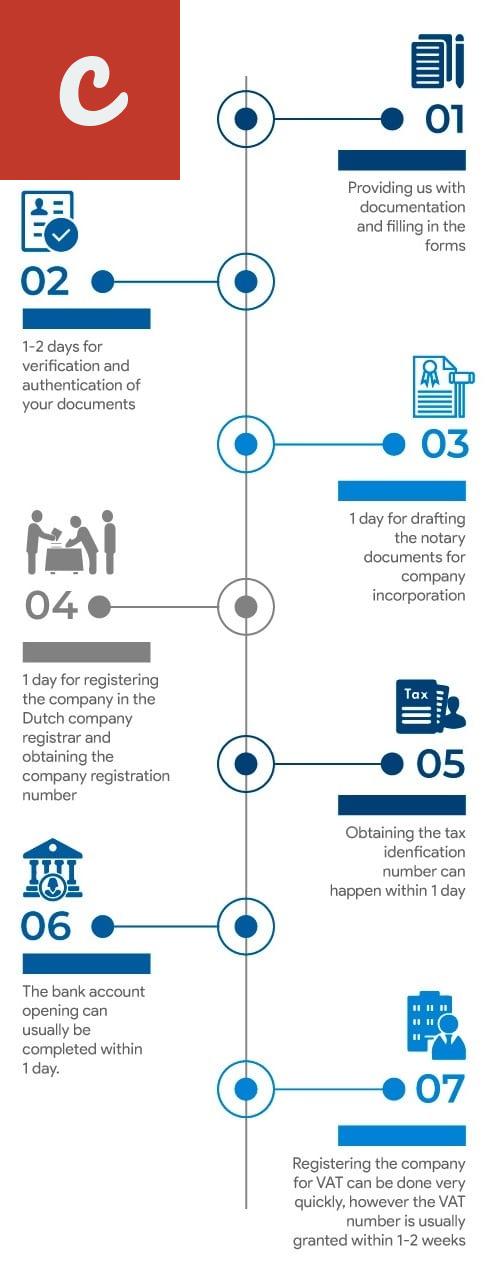

2. Register with the Chamber of Commerce: Before starting operations, you must register your company with the Dutch Chamber of Commerce (Kamer van Koophandel). This registration process requires providing essential details about your company, such as its name, legal structure, address, and business activities. Once registered, you will receive a unique Chamber of Commerce number (KvK nummer).

3. Arrange for Notarial Deed and Articles of Association: For certain legal structures, such as a private limited liability company, you need to have a notarial deed and articles of association drafted. These legal documents outline the company's structure, management, and shareholder rights. It is advisable to seek legal assistance from a notary to ensure compliance with Dutch laws and regulations.

- 4. Obtain Necessary Licenses and Permits: Depending on your business activities, you might need to acquire specific licenses and permits. This is especially important for industries such as finance, healthcare, and transportation. Research the requirements applicable to your business and apply for the necessary permits from the appropriate authorities.

- 5. Open a Business Bank Account: It's essential to open a separate business bank account for your company. This will help you manage your finances and maintain a clear distinction between personal and company funds. Choose a reputable bank that offers suitable business banking services and meets your requirements.

6. Register for Taxes: All companies in the Netherlands are required to register with the Dutch Tax and Customs Administration (Belastingdienst). Depending on your business activities, you may need to register for value-added tax (VAT), corporate income tax, payroll tax, and social security contributions. It's advisable to consult a tax advisor to ensure compliance with the Dutch tax regulations.

7. Compliance with Employment Laws: If you plan to hire employees, it's crucial to comply with Dutch employment laws. Familiarize yourself with regulations regarding contracts, working hours, minimum wages, and social security contributions. Additionally, consider providing adequate employee benefits to attract and retain talent.

8. Build a Network and Seek Professional Assistance: Networking is a key aspect of doing business in the Netherlands. Attend industry events, join business associations, and connect with local entrepreneurs. Moreover, consider seeking professional assistance from lawyers, accountants, and consultants who specialize in company formation in the Netherlands. They can provide valuable guidance and support throughout the process.

By following this comprehensive guide, you can navigate the company formation process in the Netherlands successfully. Remember to stay updated with the latest legal and regulatory requirements to ensure ongoing compliance and growth for your business.

Main Title: Key Requirements for Setting up a Company in the Netherlands

Setting up a company in the Netherlands can be a highly strategic decision, considering the country's favorable business climate and attractive investment opportunities. However, like any other country, the Netherlands has certain requirements that need to be fulfilled to establish a company. In this article, we will discuss the key requirements for setting up a company in the Netherlands.

First and foremost, one of the essential requirements is having a registered address in the Netherlands. This address will serve as the official business address, and it is imperative that it can receive official correspondence from government bodies and other relevant authorities. Additionally, having a local address gives your company a physical presence in the country, which can contribute to building trust with customers and business partners.

Another crucial requirement is the appointment of a local director. The Netherlands requires that every company has at least one director who resides in the country. This director is responsible for the day-to-day management of the company and acts as the legal representative. Having a local director ensures compliance with Dutch laws and regulations and facilitates smooth operations.

- List item 1: In order to set up a company in the Netherlands, you will need to register with the Dutch Chamber of Commerce. This registration process involves providing necessary information about the company, such as its name, activities, and legal structure.

- List item 2: Additionally, you will need to obtain a Dutch tax identification number (TIN) for your company. This number is necessary for various tax-related purposes, including filing tax returns and complying with tax obligations.

Once you have fulfilled these requirements, you can proceed with opening a business bank account. Having a local bank account is essential for conducting business operations, paying taxes, and receiving payments from clients or customers. It is important to research different banks in the Netherlands and choose the one that best suits your company's needs.

In summary, setting up a company in the Netherlands requires fulfilling several key requirements. These include having a registered address, appointing a local director, registering with the Dutch Chamber of Commerce, obtaining a Dutch tax identification number (TIN), and opening a business bank account. By complying with these requirements, you can establish a successful business in the Netherlands and take advantage of the country's favorable business environment.

Forming a Company in the Netherlands: A Step-by-Step Process

Are you considering starting a company in the Netherlands? The Netherlands is known for its favorable business climate, well-developed infrastructure, and strategic location in Europe. In this article, we will guide you through the step-by-step process of forming a company in the Netherlands.

Step 1: Decide on the legal structure of your company

The first step in forming a company in the Netherlands is to decide on the legal structure that best suits your business. The most common legal structures for companies in the Netherlands are:

- Sole Proprietorship: Suitable for individuals looking to start a business on their own.

- Partnership: Ideal for businesses with two or more owners.

- Limited Liability Company (BV): Popular among entrepreneurs looking for limited liability and a separate legal entity.

Step 2: Choose a unique company name

Once you have decided on the legal structure of your company, it's time to choose a unique name. The Netherlands has specific rules and regulations regarding company names. Your chosen name should not be similar to existing company names and should not infringe on trademarks.

Step 3: Draft and sign the articles of association

The next step involves drafting the articles of association for your company. These documents outline the internal regulations and operations of your company. It is recommended to consult a legal professional or a notary to ensure that the articles of association comply with Dutch laws and regulations.

Step 4: Register your company with the Trade Register

After preparing the necessary legal documents, you need to register your company with the Dutch Trade Register. The Trade Register is maintained by the Netherlands Chamber of Commerce (KvK). To complete the registration, you will need to provide your company's articles of association, proof of identity, and other necessary documents. Registration can be done online or by visiting the KvK office in person.

Step 5: Obtain any required business permits and licenses

Depending on the nature of your business, you may need to obtain specific permits or licenses. This step is crucial, as operating a business without the necessary permits can lead to fines or even closure of your business. Make sure to research the requirements and apply for the relevant permits or licenses from the responsible authorities.

Step 6: Register for taxes and social security contributions

As a company in the Netherlands, you are required to register for taxes and social security contributions. This includes registering for VAT (Value Added Tax) and corporate income tax. Consult a tax advisor or an accountant to ensure compliance with tax regulations and to determine your tax obligations.

By following these six steps, you can successfully form a company in the Netherlands. Remember to seek professional guidance throughout the process to ensure a smooth and legally sound establishment of your business.

Main Title: Essential Requirements for Incorporating a Company in the Netherlands

Are you planning to start a company in the Netherlands? Incorporating a business can be an exciting and rewarding venture. However, it is crucial to understand the essential requirements and steps involved in setting up a company in the Netherlands. By following the correct procedures, you can ensure a smooth and hassle-free incorporation process. In this article, we will discuss the necessary requirements for incorporating a company in the Netherlands.

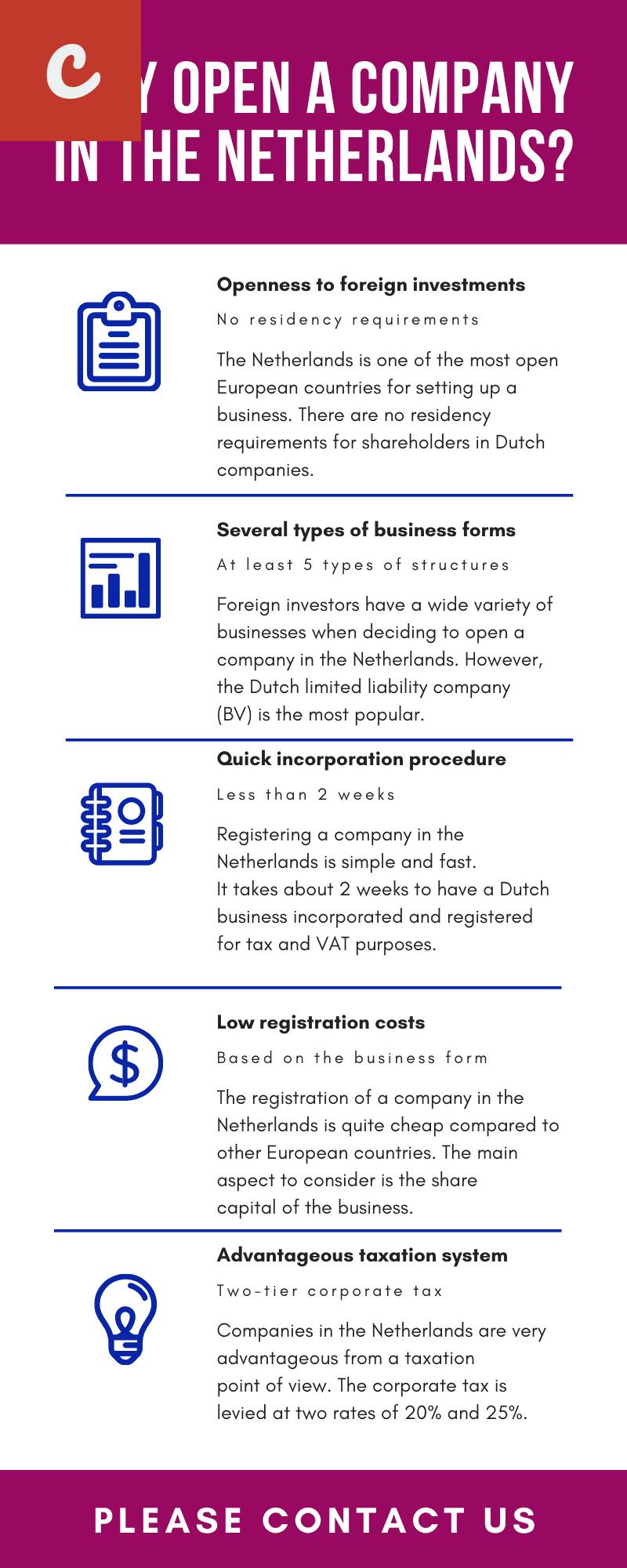

Before diving into the requirements, it is essential to note that the Netherlands offers various business structures, including private limited companies (Besloten Vennootschap or BV), partnerships, sole proprietorships, and more. Each structure has its advantages and disadvantages, so it is crucial to choose the one that suits your business goals and objectives.

1. Business Plan

A business plan is a crucial requirement when incorporating a company in the Netherlands. It outlines your company's goals, strategies, products/services, market analysis, and financial projections. This document is necessary to demonstrate the viability and potential of your business to investors, banks, and potential partners.

2. Chamber of Commerce Registration

Every company in the Netherlands must register with the Chamber of Commerce (Kamer van Koophandel or KvK). This registration is necessary for obtaining a unique registration number, known as a KvK number, which is mandatory for all businesses. The registration process can be done online or in-person, and you will need to provide various documents, including identification, business plan, memorandum of association, and more.

3. Notarial Deed of Incorporation

The next step is to create a notarial deed of incorporation, also known as the Articles of Association. This document outlines the company's structure, shareholders, management, and other essential details. The deed must be prepared by a civil-law notary in the Netherlands and signed by all shareholders. Once the notarial deed is registered with the Chamber of Commerce, your company becomes legally incorporated.

4. Registered Office and Address

It is a legal requirement to have a registered office address in the Netherlands. This address will serve as the official contact point for your company, and all official correspondence will be sent there. Additionally, a company must have a physical business address where its operations are carried out. The registered office and business address can be the same or different, depending on your business needs.

5. Share Capital

When incorporating a private limited company (BV), you are required to have a minimum share capital of 0.01 Euro. The share capital can be contributed in cash or in-kind. However, it is important to note that the share capital can be increased based on the needs and requirements of your business.

6. VAT Registration

If your business exceeds the annual VAT threshold, which is currently set at 20,000 Euros, you must register for Value Added Tax (VAT) with the Dutch Tax and Customs Administration. This registration is necessary to collect and remit VAT on your products or services.

- List item 1: Business Plan

- List item 2: Chamber of Commerce Registration

- List item 3: Notarial Deed of Incorporation

- List item 4: Registered Office and Address

- List item 5: Share Capital

- List item 6: VAT Registration

Remember, the requirements for incorporating a company in the Netherlands may vary based on the type of business structure and industry. It is advisable to consult professionals or legal experts who can guide you through the process and ensure compliance with all legal obligations. By fulfilling these essential requirements, you can establish your company in the Netherlands and embark on a successful entrepreneurial journey.

Important Considerations for Establishing a Business in the Netherlands

If you are considering expanding your business to Europe, the Netherlands is a country that should be on your radar. Known for its strong entrepreneurial spirit, excellent infrastructure, and favorable business climate, the Netherlands offers numerous opportunities for foreign companies to establish and thrive.

Why the Netherlands?

With its central location in Europe, the Netherlands serves as a gateway to the continent's major markets. The country boasts a well-developed transportation network, including one of the world's largest ports in Rotterdam, making it easy to connect with customers and suppliers across Europe.

In addition, the Netherlands has a highly educated and multilingual workforce, making it an attractive destination for businesses in various sectors. The country also has a strong commitment to innovation and research, with numerous universities, research institutes, and innovation hubs.

- Legal and Administrative Requirements

Before establishing a business in the Netherlands, it is crucial to familiarize yourself with the legal and administrative requirements. One of the first steps is to register your company with the Dutch Chamber of Commerce (KvK). You will need to provide information about the legal structure of your business, such as whether it will be a sole proprietorship or a limited liability company (BV).

Furthermore, it is important to understand the Dutch tax system and ensure compliance with local tax regulations. Hiring an accountant or tax advisor who is familiar with the Dutch tax system can be highly beneficial in navigating this complex area.

- Business Culture and Language

Understanding the Dutch business culture is essential for successfully establishing and running a business in the country. Dutch people value directness, efficiency, and punctuality. They appreciate being well-prepared for meetings and expect clear and concise communication.

English is widely spoken in the Netherlands, especially in the business world. However, learning some basic Dutch phrases and customs can go a long way in building relationships with local business partners.

- Financial Considerations

When starting a business in the Netherlands, it is important to have a solid financial plan in place. The country offers various financing options, such as government grants and subsidies, which can support the growth of your business.

Additionally, opening a business bank account in the Netherlands is essential for managing your finances effectively. There are several Dutch and international banks operating in the country, offering a range of banking services tailored to meet the needs of businesses.

- Networking and Support

Networking is crucial for establishing a strong presence in the Dutch business community. Joining industry-specific associations and attending trade fairs and business events can help you build valuable connections and gain insights into the local market.

Moreover, the Netherlands offers excellent support for new businesses. Organizations such as the Netherlands Foreign Investment Agency (NFIA) and Chamber of Commerce provide guidance and resources for foreign companies looking to establish themselves in the country.

In conclusion, establishing a business in the Netherlands can be highly rewarding, thanks to the country's favorable business environment and strategic location. By understanding the legal requirements, adapting to the business culture, and tapping into local support networks, you can pave the way for a successful expansion into this dynamic market.

Comments on "Requirements For Company Formation In The Netherlands"

No comment found!