Main Title

The Ultimate Guide to Setting Up a Business in the Netherlands

Starting a business in the Netherlands can be a rewarding venture for entrepreneurs looking to expand their horizons. With its strong economy, innovative business climate, and favorable tax system, the Netherlands offers many opportunities for success. This guide will walk you through the essential steps and considerations when setting up a business in the Netherlands.

- List item 1: Determine your business structure - The first step in setting up a business in the Netherlands is to decide on the most suitable legal structure. Options include sole proprietorship, partnership, private limited company (BV), and public limited company (NV). Each structure has its own benefits and implications, so it is important to carefully consider your specific needs and objectives.

- List item 2: Register with the Chamber of Commerce - Once you have chosen your business structure, you need to register your company with the Netherlands Chamber of Commerce (Kamer van Koophandel, or KvK). This is a mandatory step that provides your business with a unique identification number and enables you to legally operate in the country.

It is crucial to thoroughly research and understand the legal and tax requirements associated with your chosen business structure. Consulting with a legal professional or business advisor experienced in Dutch law is highly recommended to ensure compliance with all necessary regulations.

Paragraph 3: Secure financing - Funding is a critical aspect of starting a business. In the Netherlands, several options are available, including bank loans, venture capital, crowdfunding, and government grants. Your business plan and financial projections will play a crucial role in securing financing, so make sure to prepare them in detail.

To improve your chances of attracting investors or lenders, it is essential to have a solid understanding of the Dutch market, competition, and potential customers. Conducting thorough market research and developing a comprehensive marketing strategy can greatly enhance your business's appeal to potential investors.

Paragraph 4: Understand tax obligations - Like any other country, the Netherlands has its own tax regulations that businesses need to comply with. It is important to be aware of the various taxes that may apply to your business, such as corporate income tax, value-added tax (VAT), and payroll taxes.

Consulting with a tax advisor who specializes in Dutch taxation is highly recommended to ensure you fulfill your tax obligations and make the most of applicable tax incentives and deductions.

Paragraph 5: Hire employees - If your business requires employees, you need to familiarize yourself with Dutch labor laws and regulations. This includes understanding employee rights, minimum wage requirements, and the process for hiring and terminating employees.

Furthermore, consider seeking guidance from an employment expert or HR consultant to ensure compliance with all labor-related obligations and to establish fair and effective employment practices.

In conclusion, setting up a business in the Netherlands can be an exciting and prosperous endeavor. By carefully considering your business structure, fulfilling legal and tax requirements, securing financing, and complying with labor laws, you can lay a strong foundation for success.

Everything You Need to Know About Starting a Business in the Netherlands

Starting a business in the Netherlands can be an exciting opportunity. With its strong economy and favorable business climate, this country offers great potential for entrepreneurs. However, before diving in, it is important to understand the essentials of starting a business in the Netherlands. Here is everything you need to know.

Business Registration

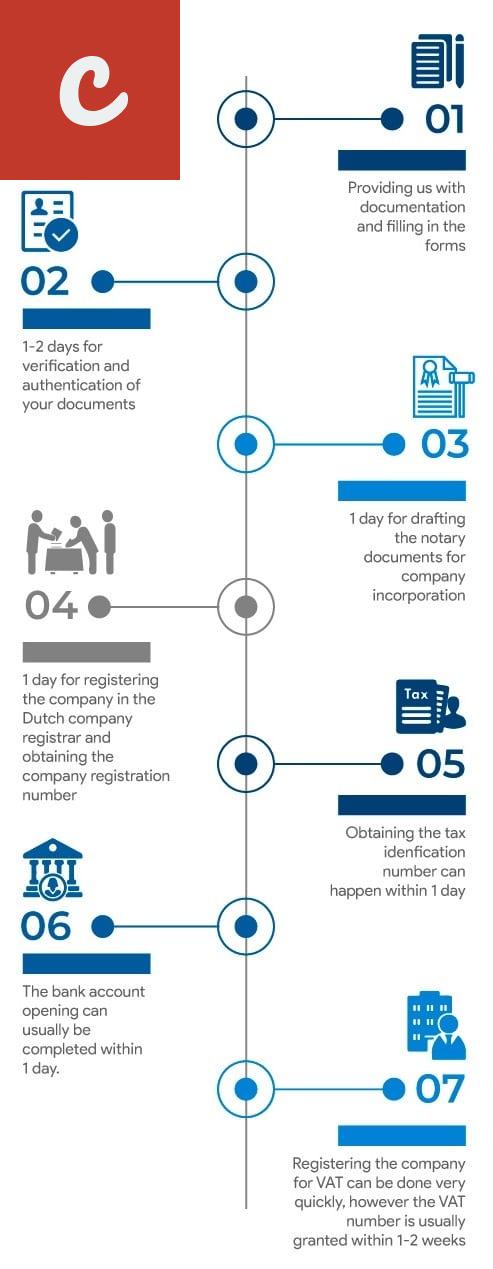

The first step in starting a business in the Netherlands is registering your company with the Chamber of Commerce (Kamer van Koophandel - KvK). This process can be done online and requires certain details about your business such as its name and legal structure.

- Legal Structure: The Netherlands offers different legal structures for businesses, including sole proprietorships, partnerships, and private limited liability companies (BV). Each structure has its own set of advantages and disadvantages, so it is important to choose the one that best suits your business.

- VAT Registration: Depending on the nature of your business, you may need to register for Value Added Tax (VAT) with the tax authorities. This is mandatory if your turnover exceeds a certain threshold.

Business Plan

Having a solid business plan is crucial for the success of your venture. This document outlines your goals, target market, marketing strategies, financial projections, and more. A well-crafted business plan not only helps you stay focused but also attracts potential investors or lenders.

Financial Considerations

Starting a business requires careful financial planning. Besides the initial capital needed to set up your company, you also need to consider ongoing expenses, such as rent, utilities, employee salaries, and taxes. Having a separate bank account for your business is essential to keep your personal and business finances separate.

Obtaining Permits and Licenses

Depending on the nature of your business, you may need to obtain certain permits or licenses to operate legally in the Netherlands. This could include permits for specific industries, such as food services or healthcare. It is important to research and comply with the regulations relevant to your business.

Hiring Employees

If you plan to hire employees, familiarize yourself with Dutch employment law. This includes regulations regarding minimum wage, working hours, vacation days, and social security contributions. It is crucial to understand your obligations as an employer and ensure compliance.

Taxation and Accounting

Understanding the Dutch tax system is important for any business owner. Familiarize yourself with the various taxes applicable to businesses, such as corporate income tax, payroll tax, and VAT. It is advisable to hire an accountant or tax advisor to ensure proper compliance with tax regulations.

Seeking Professional Advice

Starting a business in the Netherlands involves many legal, financial, and administrative aspects. Seeking professional advice from lawyers, accountants, and business consultants can save you time and ensure you make informed decisions. They can guide you through the process and assist with any complexities.

Starting a business in the Netherlands offers a multitude of opportunities. By understanding the necessary steps and seeking professional guidance, you can set your business up for success in this thriving European market.

Main Title: Step-by-Step Guide to Establishing a Business in the Netherlands

If you are considering expanding your business into Europe, the Netherlands is an excellent choice. With its stable economy, strategic location, and business-friendly environment, the Netherlands is one of the preferred destinations for entrepreneurs. This article will provide you with a step-by-step guide on how to establish a business in the Netherlands.

1. Determine the Legal Structure: The first step is to decide on the legal structure of your business. The most common options in the Netherlands are sole proprietorship (eenmanszaak), partnership (vof), private company (bv), or public limited company (nv). Each structure has its pros and cons, so it’s essential to choose the one that suits your needs.

2. Register with the Chamber of Commerce: Regardless of the legal structure you choose, you must register your business with the Chamber of Commerce (Kamer van Koophandel or KvK). This registration process includes providing details such as your company name, address, and information about the owners.

- List item 1: Prepare the Necessary Documents: To complete the registration process, you will need to gather specific documents, such as identification proof, proof of address, and a copy of your business plan. It's crucial to have all the necessary paperwork ready to avoid delays.

- List item 2: Appoint a Dutch Resident Director (if applicable): If you decide to form a bv or nv, you will need to appoint a Dutch resident director. This individual must have a valid residency permit and play an essential role in managing the company's affairs.

3. Obtain Business Permits and Licenses: Depending on the nature of your business, you may need to obtain specific permits or licenses before you can start operations. Examples include a general business license, a specialized trade license, or permits in regulated sectors such as finance or healthcare. Research the requirements for your industry and ensure compliance.

4. Open a Business Bank Account: To operate a business in the Netherlands, you must have a Dutch bank account. Contact various banks to compare their offerings and choose the one that best suits your needs. The bank will require you to provide your Chamber of Commerce registration documents and identification proof to open the account.

5. Register for Taxes: As a business owner, you need to register for various taxes in the Netherlands. The most common ones are the Value Added Tax (VAT) and the Corporate Income Tax. Registering for taxes ensures that you comply with the Dutch tax regulations and avoid any penalties.

6. Hire Employees (if applicable): If your business requires employees, it's essential to navigate the Dutch employment regulations. Familiarize yourself with employment contracts, minimum wage laws, and other labor regulations. You may also need to register with relevant authorities such as the Employee Insurance Agency (UWV) or pension funds.

7. Arrange Business Insurance: Protect your business by obtaining the necessary insurance coverage. Consider options such as liability insurance, property insurance, or professional indemnity insurance, depending on the nature of your business. Insurance safeguards your company against unforeseen risks and provides peace of mind.

8. Find a Suitable Business Location: The location of your business plays a crucial role in its success. Determine the best city or area in the Netherlands that aligns with your target market and industry. Consider factors such as proximity to customers, transportation infrastructure, and availability of resources.

9. Establish a Network: Building a network is vital for the success of your business in the Netherlands. Attend industry events, join business associations, and connect with local entrepreneurs to expand your contacts. Networking helps you gain insights into the market, find potential partners or clients, and stay updated on industry trends.

In conclusion, establishing a business in the Netherlands requires careful planning and adherence to legal procedures. By following this step-by-step guide, you can navigate through the process smoothly and set up your business successfully. The Netherlands offers a supportive environment for entrepreneurs, and with the right strategy, your business can thrive in this thriving European market.

Key Considerations for Setting Up a Successful Business in the Netherlands

If you are considering starting your own business, the Netherlands is an attractive country to set up shop. Known for its business-friendly environment and strong economy, the Netherlands offers numerous advantages for entrepreneurs. However, before diving in, there are several key considerations you should keep in mind.

1. Legal Structure: Choose the legal structure that suits your business needs. The most common options in the Netherlands are sole proprietorship (eenmanszaak), partnership (vennootschap onder firma), and private limited company (besloten vennootschap).

2. Business Plan: Develop a comprehensive business plan that outlines your goals, objectives, and strategies. This plan will serve as your roadmap and help you secure funding or attract investors.

3. Market Research: Conduct thorough market research to identify your target audience, competitors, and potential demand for your products or services. This will enable you to position your business effectively and gain a competitive edge.

4. Location: Consider the location of your business carefully. The Netherlands offers various cities and regions with unique advantages and industry clusters. Choose a location that aligns with your business activities and target market.

5. Taxation: Familiarize yourself with the Dutch tax system. The Netherlands has a favorable tax climate for businesses, with various tax incentives and deductions available. Consult an expert to ensure you understand your tax obligations and make the most of available benefits.

- 6. Business Registration: Register your business with the Dutch Chamber of Commerce (Kamer van Koophandel, or KvK). This registration is mandatory and will give your business a unique identification number.

- 7. Permits and Licenses: Determine whether your business requires any specific permits or licenses to operate legally. This may vary depending on the nature of your business activities.

8. Hiring Employees: If you plan to hire employees, familiarize yourself with Dutch labor laws and regulations. Ensure compliance with employment contracts, minimum wage requirements, and other legal obligations.

9. Networking: Building a strong network in the Netherlands is crucial for business success. Attend industry events, join local business associations, and connect with professionals in your field to expand your network and potential business opportunities.

10. Language: English is widely spoken in the Netherlands, but learning Dutch can be beneficial for business dealings and building relationships with local partners or customers.

By considering these key factors, you can set up your business for success in the Netherlands. Remember to seek professional guidance and stay informed about legal and regulatory changes that may affect your business operations.

Main Title: Navigating the Legal and Financial Requirements of Business Setup in the Netherlands

Starting a business in the Netherlands can be an exciting and profitable venture. However, before diving into the process, it is essential to understand the legal and financial requirements involved in setting up a business in this European country.

First and foremost, it is crucial to determine the legal structure of your business. The Netherlands offers several options, including sole proprietorship, partnership, private limited company (BV), and public limited company (NV). Each legal structure has its advantages and disadvantages, so it is wise to seek legal advice to determine which structure best suits your business goals and interests.

- List item 1: Sole Proprietorship: This structure is suitable for small businesses with a single owner. It offers simplicity in terms of administration and taxation, but the owner assumes unlimited liability.

- List item 2: Private Limited Company (BV): A BV is a separate legal entity that offers limited liability to its shareholders. This structure is commonly chosen by medium to large-sized businesses.

Once you have chosen the legal structure, you need to register your business with the Dutch Chamber of Commerce (KVK). The registration process involves submitting necessary documents such as identification, proof of address, and a business plan.

Keyword: business setup in the Netherlands

To ensure compliance with Dutch law, it is advisable to seek legal assistance in drafting the necessary documents and contracts. This step will help protect your business interests and avoid any future legal issues.

Businesses in the Netherlands must adhere to specific financial regulations. It is mandatory to maintain proper financial records, including balance sheets, profit and loss statements, and cash flow statements. Hiring an accountant or bookkeeper can ensure the accuracy of these financial records and help you meet your tax obligations.

Keyword: legal and financial requirements

Another significant financial aspect is taxation. The Dutch tax system is relatively complex, with various types of taxes and regulations. You must understand and comply with these tax obligations to avoid penalties or legal consequences. It is recommended to consult with a tax specialist who can guide you through the tax planning and compliance process.

In addition to legal and financial requirements, it is essential to consider other factors such as market research, competition analysis, and a solid business plan. Understanding the local market, consumer preferences, and competition will contribute to the success of your business in the Netherlands.

In conclusion, setting up a business in the Netherlands involves navigating through legal and financial requirements. Choosing the right legal structure, registering your business, and complying with financial regulations are vital steps in establishing a successful business. Seeking professional advice and assistance can help you overcome challenges during this process. By understanding and fulfilling these requirements, you can start your business in the Netherlands with confidence.

Comments on "Setting Up A Business In The Netherlands: A Complete Guide"

No comment found!