Everything You Need to Know About Company Formation in the Netherlands

The Netherlands, with its favorable business climate and robust economy, has become an attractive destination for entrepreneurs and corporate businesses looking to expand their reach in Europe. If you are considering company formation in the Netherlands, here is everything you need to know:

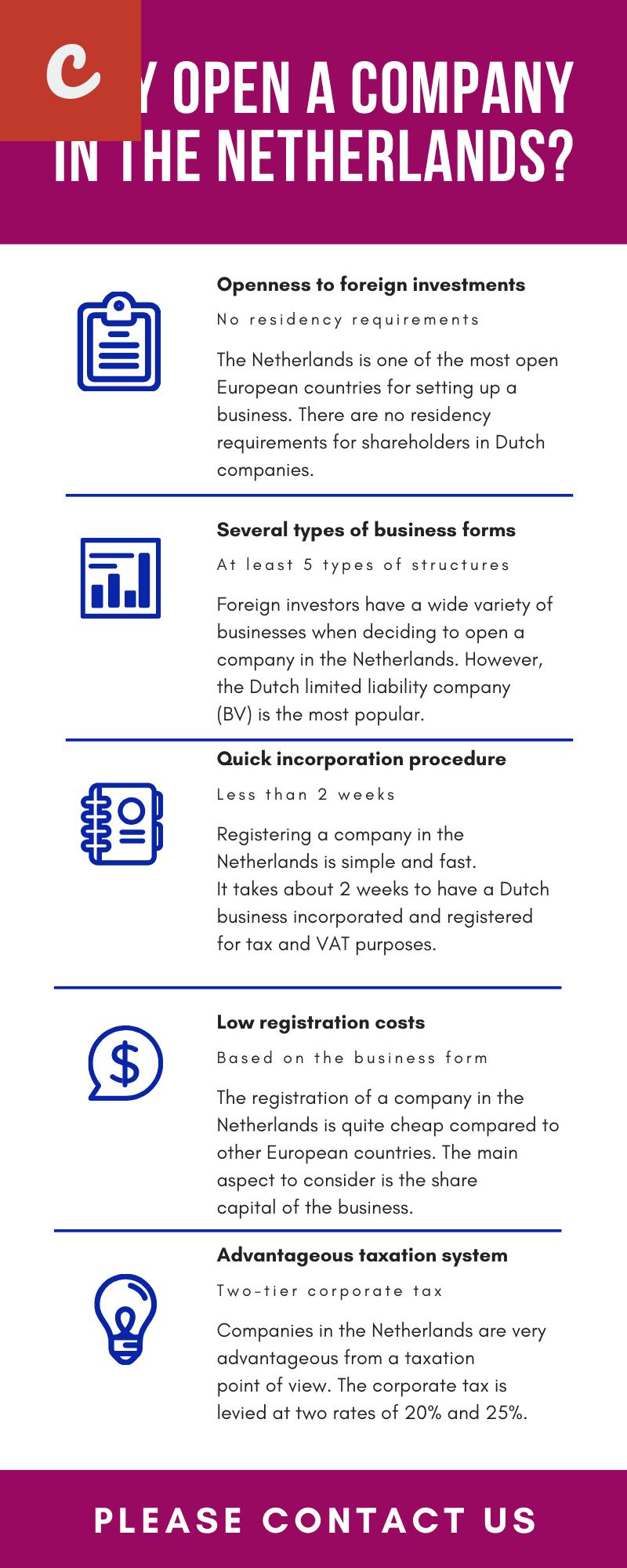

1. Legal Structure: The Netherlands offers several legal structures for businesses, including sole proprietorship, partnership, and limited liability company. A limited liability company, known as a "Besloten Vennootschap" or BV, is the most common form chosen by investors due to its flexibility and protection of personal assets.

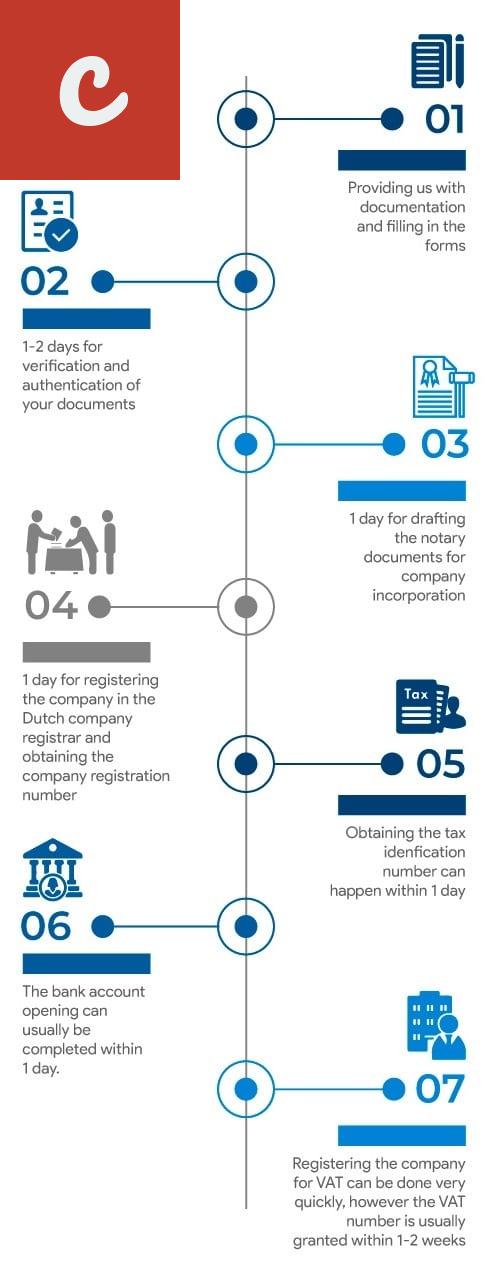

2. Registration Process: To register your company in the Netherlands, you need to follow a few steps. First, choose a unique company name and reserve it with the Dutch Trade Register. Then, draft the company's articles of association, which include the purpose, share capital, and management structure. Finally, submit the necessary documents to the Dutch Chamber of Commerce and pay the registration fee.

- List item 1: Provide a valid identification document, such as a passport or ID card, for each director and shareholder.

- List item 2: Prepare a notarial deed of incorporation, which must be signed by a civil-law notary.

3. Share Capital: Limited liability companies in the Netherlands require a minimum share capital of €0.01. However, in practice, it is common to set the initial share capital at a higher amount, typically €1,000 or more, to demonstrate credibility with potential business partners and investors.

4. Taxation: The Netherlands has an attractive tax regime for businesses. The corporate income tax rate is 15% for profits up to €245,000 and 25% for profits exceeding that amount. Additionally, the Netherlands has a favorable tax treaty network and offers various tax incentives for research and development activities.

5. Registered Office and Business Address: Your company in the Netherlands must have a registered office and a physical business address within the country. The registered office is where official documents and legal correspondence will be sent, while the business address is where your day-to-day operations will take place.

6. Employment Regulations: Before starting operations in the Netherlands, it is essential to familiarize yourself with Dutch employment regulations. This includes understanding the Dutch labor law, minimum wage requirements, working hours, and employee rights.

7. Hiring Employees: If you plan to hire employees in the Netherlands, you must register as an employer with the Dutch Tax and Customs Administration. Additionally, you need to ensure compliance with Dutch employment contracts, payroll taxes, and social security contributions.

Conclusion: Company formation in the Netherlands can be a straightforward process if you understand the legal requirements and follow the necessary steps. Consider consulting with professionals who specialize in Dutch company formation to ensure a smooth and successful incorporation process. With the right guidance, your business can thrive in the vibrant and business-friendly environment of the Netherlands.

The Ultimate Guide to Setting Up a Business in the Netherlands

If you are considering starting a business in Europe, the Netherlands is a great choice. With its favorable business climate, robust infrastructure, and highly educated workforce, the Netherlands offers numerous opportunities for entrepreneurs. In this article, we will provide you with a step-by-step guide to help you set up your business in the Netherlands.

Step 1: Research and Planning

Before starting your business in the Netherlands, it is crucial to conduct thorough research and create a solid business plan. This will give you a clear understanding of the market, target audience, and potential competition. Additionally, it will help you outline your business goals and strategies.

Step 2: Choose the Right Business Structure

In the Netherlands, you can choose from several business structures, such as a sole proprietorship, partnership, limited liability company (LLC), or a branch office. Each structure has its own legal requirements and tax implications. It is advisable to consult with a legal or tax advisor to determine the most suitable structure for your business.

Step 3: Register your Business

Once you have decided on the business structure, you need to register your company with the Dutch Chamber of Commerce (Kamer van Koophandel or KvK). You will need to provide information about your business activities, legal structure, and shareholders. The KvK will issue you a unique company registration number, which is required for various business activities.

Step 4: Arrange Business Banking

Opening a business bank account is essential for managing your finances and transactions. Contact various banks in the Netherlands to compare the services and choose the one that suits your business needs. Prepare the necessary documents, such as proof of identity, proof of business registration, and business plan, to open a business bank account.

Step 5: Understand Tax Obligations

The Dutch tax system can be complex, and it is important to understand your tax obligations as a business owner. Familiarize yourself with applicable taxes, such as corporate income tax, value-added tax (VAT), and payroll taxes. Consider seeking professional advice from a tax advisor to ensure compliance and optimize your tax situation.

- Benefit from Business Incentives

- The Netherlands offers various incentives and subsidies to attract businesses, especially in strategic sectors like innovation, research, and development. Explore available grants and subsidies that can help fund your business activities and reduce costs.

Step 7: Find Office Space

Depending on your business type, you may need to find office or commercial space. The Netherlands offers a wide range of options, including co-working spaces, business centers, and traditional office spaces. Consider factors such as location, accessibility, and facilities when choosing the right office space for your business.

Step 8: Hire Employees (Optional)

If your business requires employees, you need to follow the Dutch employment laws and regulations. Familiarize yourself with employment contracts, minimum wages, working hours, and other labor laws. Additionally, consider outsourcing payroll and HR services to ensure compliance with Dutch labor regulations.

Conclusion

Setting up a business in the Netherlands can be a rewarding venture. By following these steps and seeking professional advice when necessary, you can navigate the process smoothly. Remember to conduct thorough research, plan strategically, and comply with legal and tax regulations to set a strong foundation for your business success.

Main Title: 7 Essential Steps to Forming a Company in the Netherlands

Are you looking to establish your own company in the Netherlands? Well, you're in luck! The Netherlands is known for its business-friendly environment and vibrant economy, making it an attractive destination for entrepreneurs and startups. However, before you dive into the exciting world of business, it's crucial to understand the essential steps involved in forming a company in the Netherlands. Let’s explore them below:

1. Determine the Legal Structure: The first step is to decide on the legal structure of your company. The most common options in the Netherlands are a sole proprietorship, partnership, private limited company (BV), or a public limited company (NV). Each structure has its own advantages and requirements, so it's important to understand your business needs before making a decision.

2. Choose a Trade Name: Your company needs a unique trade name that is not already registered in the Netherlands. Make sure the name aligns with your company's vision and is easy to remember. You can check the trade name's availability through the Chamber of Commerce website.

3. Draft Articles of Association: The Articles of Association outline the rules and regulations of your company. It includes details about the company's purpose, shareholders, management structure, and decision-making processes. You can create these articles yourself or seek professional advice from a notary or legal expert.

4. Register at the Chamber of Commerce: To establish your company legally, you must register it with the Dutch Chamber of Commerce (KvK). You can do this online or visit one of their offices in person. During the registration process, you will need to provide all the required documents and pay the necessary fees.

5. Obtain a VAT Number: If your company has a turnover exceeding a specific threshold, you will need to apply for a Dutch VAT number. This number is crucial for conducting business transactions within the European Union (EU).

- List item 1: Determine the annual turnover threshold outlined by the Dutch Tax and Customs Administration.

- List item 2: Register for a VAT number through the Tax and Customs Administration's website.

6. Set Up Accounting and Administration: Keeping proper financial records is a legal requirement in the Netherlands. You need to have a reliable administration system in place to track your income, expenses, and taxes. Hiring an accountant or using accounting software can make this process easier and ensure compliance with Dutch financial regulations.

7. Comply with Dutch Employment Regulations: If you plan on hiring employees, it's important to familiarize yourself with the Dutch employment regulations. This includes adhering to minimum wage laws, providing employee benefits, and creating employment contracts that meet the legal requirements.

Now that you know the essential steps to establish a company in the Netherlands, you can begin your entrepreneurial journey with confidence. Remember, seeking professional advice and guidance throughout the process is highly recommended to ensure compliance and avoid any legal complications. Good luck!

A Beginner's Guide to Company Formation in the Netherlands

The Netherlands is a country known for its thriving business environment and favorable tax policies. It's no wonder that many entrepreneurs and investors choose to set up their companies in this European country. If you're considering company formation in the Netherlands, this beginner's guide will walk you through the process and provide valuable insights.

Before diving into the specifics of company formation, it's crucial to understand the various legal structures available in the Netherlands. The most common types of business entities are the private limited liability company (BV) and the sole proprietorship (eenmanszaak). The BV structure is widely preferred due to its liability protection and flexibility in terms of share ownership. On the other hand, the sole proprietorship offers simplicity and straightforward setup.

- Private Limited Liability Company (BV):

- Sole Proprietorship (eenmanszaak):

A BV is a separate legal entity and requires a minimum share capital of €0.01. It offers limited liability protection, which means that the shareholder's personal assets are separate from the company's liabilities. Additionally, the BV structure allows for easy transfer of ownership and is suitable for businesses with high growth potential.

A sole proprietorship is the easiest form of company to set up in the Netherlands. It has no minimum capital requirements and is solely owned by one individual. However, there is no distinction between personal and business assets, meaning the owner is personally liable for any debts or obligations of the company.

Once you have decided on the legal structure that best suits your business needs, the next step is to register your company with the Chamber of Commerce (KVK). This is a mandatory requirement for all businesses operating in the Netherlands. During the registration process, you'll need to provide details such as the company name, address, type of business, and company directors.

It's important to note that the company name plays a vital role in branding and marketing. In addition to being unique and memorable, it should reflect the nature of your business. It's also a good idea to conduct a name check with the KVK to ensure that your chosen name is not already in use.

After the company registration is complete, you'll receive a KVK number, which serves as your official identification. You'll need this number for various purposes, including opening a business bank account, filing tax returns, and entering into contracts.

To make your company formation process smoother, it's highly recommended to seek the assistance of a professional service provider or a notary. They can guide you through the legal requirements, help with the preparation of necessary documents, and ensure compliance with local regulations.

In conclusion, company formation in the Netherlands offers many advantages for entrepreneurs and investors. The choice of legal structure, whether it be a BV or a sole proprietorship, depends on your individual circumstances and future growth plans. Remember to register your company with the KVK and seek professional help to ensure a smooth and successful setup.

The Step-by-Step Guide to Company Formation in the Netherlands is a comprehensive resource for anyone looking to establish a business in this thriving European country. From understanding the legal requirements to navigating the bureaucratic process, this guide provides invaluable insights and information. Whether you are a local entrepreneur or an international investor, the Netherlands offers a favorable business environment and numerous opportunities. With the help of this guide, you can easily navigate the complexities of setting up a company in the Netherlands. For more detailed information, you can refer to the Netherlands Company Formation Guide.

Main Title

Starting a company can be a daunting task, especially when dealing with a foreign market. However, company formation in the Netherlands can be a viable option for international entrepreneurs looking to expand their business horizons. The Netherlands is known for its strong economy, strategic location, advanced infrastructure, and favorable business climate. Before embarking on the journey of company formation in the Netherlands, there are a few key considerations to keep in mind.

- Legal Structure: One of the first decisions to make is the legal structure of your company. The Netherlands offers various options such as sole proprietorship, partnership, private limited liability company (BV), and public limited liability company (NV). Each structure has its own advantages and disadvantages, so it's essential to choose the one that best aligns with your business goals and needs.

- Business Plan: A well-crafted business plan is crucial for successful company formation. It should outline your company's objectives, target market, marketing strategies, financial projections, and risk analysis. A solid business plan not only helps you stay focused but also serves as a valuable tool when seeking investment or financing opportunities.

Once these initial considerations are addressed, there are a few additional steps to take when forming your company in the Netherlands:

- Company Name: Choosing a unique and memorable company name is essential. The name should be easy to pronounce and reflect your brand identity. It's important to check if the desired name is available and compliant with Dutch naming regulations. The Dutch Chamber of Commerce (KVK) provides a free name check tool for this purpose.

- Registration and Notarization: Registering your company with the KVK is mandatory for legal operation in the Netherlands. The registration process involves providing necessary documentation and paying registration fees. Additionally, some legal entities like BVs and NVs require notarization of the articles of association by a civil-law notary.

- Taxation: Understanding the Dutch tax system and obligations is vital. The Netherlands has an attractive tax regime for businesses, but it can be complex. Consider consulting a tax expert to ensure compliance with tax regulations and to optimize your tax position.

- Bank Account: Opening a Dutch bank account is essential for business operations. Most Dutch banks require a physical presence in the country to open a business bank account. Having a local bank account facilitates financial transactions, payroll management, and tax compliance.

- Employment Regulations: If you plan to hire employees in the Netherlands, it's important to familiarize yourself with local employment regulations. The Dutch labor market is highly regulated, and employers are obligated to comply with rules regarding wages, working hours, employment contracts, and social security contributions.

Lastly, it's advisable to seek professional guidance throughout the company formation process. Engaging a company formation specialist, lawyer, or accountant who has experience dealing with Dutch laws and regulations can save time, minimize risks, and ensure a smoother incorporation process.

Company formation in the Netherlands offers opportunities for international entrepreneurs to tap into a thriving economy and establish a successful business presence. By considering the legal structure, crafting a comprehensive business plan, addressing key steps such as name registration, notarization, taxation, bank account opening, and understanding employment regulations, entrepreneurs can pave the way for a prosperous venture in the Netherlands.

Comments on "Step-by-Step Guide To Company Formation In The Netherlands "

No comment found!