Main Title: The Step-by-Step Process of Company Formation in the Netherlands

Are you considering starting a business in the Netherlands? Well, you're on the right track. The Netherlands is not only a strategic location in Europe but also a business-friendly country that offers numerous benefits for entrepreneurs. To help you get started, we have outlined a step-by-step process for company formation in the Netherlands.

- List item 1: Research and Planning

The first step in company formation is conducting thorough research and planning. This involves identifying your business idea, target market, competition, and potential profitability. You should also consider the legal requirements, tax implications, and any industry-specific regulations that may affect your business.

- List item 2: Choose your Business Structure

Next, you need to decide on the legal structure of your company. The most common options in the Netherlands are sole proprietorship (eenmanszaak), partnership (vennootschap onder firma), private limited liability company (besloten vennootschap or BV), and public limited liability company (naamloze vennootschap or NV).

- List item 3: Register with the Dutch Chamber of Commerce

Once you have chosen your business structure, you need to register your company with the Dutch Chamber of Commerce (Kamer van Koophandel or KvK). You will need to provide information about your business, such as the company name, registered address, activities, and shareholders. This registration is necessary for legal purposes and to obtain a unique company identification number (KvK number) for your business.

- List item 4: Obtain Necessary Permits and Licenses

Certain business activities in the Netherlands require specific permits or licenses. Depending on the nature of your business, you may need to obtain permits related to health and safety, environmental regulations, trade licenses, or professional qualifications. It is crucial to research and understand the requirements for your specific industry to ensure compliance.

- List item 5: Open a Business Bank Account

To separate your personal and business finances, it is essential to open a business bank account. This account will be used for all financial transactions related to your company. The bank will require your KvK number, identification documents, and proof of address to open the account.

- List item 6: Prepare Legal Documents

As part of the company formation process, you will need to prepare legal documents such as articles of association, shareholder agreements, and employment contracts. It is advisable to consult with a legal professional to ensure that all the necessary legal requirements are met and your business interests are protected.

- List item 7: Register for Taxes

Registering for taxes is a crucial step for any business in the Netherlands. You will need to obtain a tax identification number (btw nummer) and register for VAT (Value Added Tax) if your business meets the threshold. Additionally, you will need to comply with payroll tax and social security contributions if you have employees.

By following these steps, you will be well on your way to successfully forming your company in the Netherlands. Remember to seek professional advice when necessary and stay informed about any updates or changes in the legal and regulatory environment.

Main Title: Key Factors to Consider When Setting Up a Company in the Netherlands

Are you thinking of expanding your business to a new country? The Netherlands is a popular choice for many businesses due to its strong economy, central location, and business-friendly environment. However, setting up a company in the Netherlands requires careful consideration of several key factors. Let's explore these factors to ensure a smooth and successful setup process.

1. Legal Structure: The first step is to determine the legal structure of your company in the Netherlands. The most common options are a private limited liability company (BV) or a branch office. Each structure has its own advantages and considerations, so it's crucial to understand the implications of each before making a decision.

- Private limited liability company (BV): This is the most popular choice for foreign businesses. It offers limited liability protection, a separate legal entity, and a flexible tax regime.

- Branch office: A branch office is an extension of the foreign parent company. It doesn't have separate legal status, and the foreign parent company remains liable for its obligations. This option may be suitable for businesses seeking a stronger connection to their parent company.

2. Taxation: Understanding the Dutch tax system is essential for your company's financial planning. The Netherlands has a competitive corporate tax rate of 15-25% and offers various incentives for foreign businesses. It's important to consult with a tax advisor to optimize your tax structure and ensure compliance with Dutch tax laws.

3. Business Registration: To legally establish your company in the Netherlands, you'll need to register with the Dutch Chamber of Commerce (KVK). The registration process involves providing relevant documents, such as Articles of Association and proof of address. Working with a local legal expert can streamline this process and ensure all requirements are met.

4. Employment Regulations: The Netherlands has extensive labor laws and regulations that protect employees and provide a favorable working environment. Familiarize yourself with Dutch employment law, including hiring procedures, minimum wage, working hours, and employee benefits. This will help you meet your obligations as an employer and maintain a positive work environment.

5. Banking and Financial Services: Opening a Dutch bank account is essential for your company's financial activities. Be sure to choose a reputable bank that offers efficient online banking services and supports international transactions. Additionally, consider other financial services your company may need, such as insurance, payroll services, and accounting support.

6. Language and Culture: While many Dutch professionals speak English fluently, having a general understanding of the Dutch language and culture can be advantageous. It assists with business interactions, networking, and building relationships. Consider investing in language and cultural training for your employees to facilitate a smooth integration into the Dutch business environment.

7. Networking and Support: Networking plays a significant role in business success. Establishing connections with local business communities, industry associations, and trade organizations can provide valuable support and opportunities. Attend business events, join networking groups, and collaborate with local partners to expand your network and gain market insights.

In conclusion, setting up a company in the Netherlands requires careful consideration of several key factors, including the legal structure, taxation, business registration, employment regulations, banking and financial services, language and culture, as well as networking and support. By thoroughly analyzing and addressing these factors, you can pave the way for a successful venture in the Netherlands. Good luck!

Top Tips for Successful Company Formation in the Netherlands

Are you considering starting a business in the Netherlands? The Netherlands is known for its favorable business climate and strategic location in the heart of Europe. However, successfully forming a company in the Netherlands requires careful planning and understanding of the local regulations. Here are some top tips to help you navigate the process and ensure a successful company formation:

1. Research and choose the right legal structure: Before starting a business in the Netherlands, it's crucial to research and choose the most suitable legal structure for your company. Options include a sole proprietorship, partnership, private limited liability company (BV), or a branch office of a foreign company. Each structure has its own advantages and disadvantages, so consult with a legal expert to determine the best fit for your business.

- 2. Create a solid business plan: A well-crafted business plan is essential for a successful company formation. It outlines your goals, market analysis, target customers, and financial projections. A comprehensive business plan will not only help you secure funding but also provide a roadmap for your business's future growth.

- 3. Register your company with the Chamber of Commerce: To legally operate your business in the Netherlands, you must register with the Chamber of Commerce (Kamer van Koophandel or KvK). During this registration process, you will receive a unique identification number (KvK-number) that must be displayed on your business documents.

- 4. Secure necessary permits and licenses: Depending on the nature of your business, you may need to obtain specific permits or licenses. It's essential to research and understand the legal requirements related to your industry to ensure compliance.

- 5. Open a Dutch business bank account: Opening a separate business bank account is mandatory in the Netherlands. This account will be used to handle financial transactions related to your company. Choose a reliable bank that offers suitable business banking services to meet your needs.

- 6. Hire an experienced accountant: The Dutch tax system is complex, and compliance with tax regulations is crucial for your company's success. Hiring an experienced accountant will ensure proper financial management, tax reporting, and compliance with legal requirements.

7. Understand employment regulations: If you plan to hire employees in the Netherlands, it's essential to understand the country's employment regulations. These regulations cover topics such as minimum wage, working hours, vacation entitlements, and termination procedures. Complying with these regulations is critical to building a responsible and legally compliant workforce.

8. Seek professional advice: Engaging the services of experienced professionals, such as lawyers, accountants, and business consultants, can greatly assist you in successfully setting up your company in the Netherlands. They can guide you through the legal complexities, offer valuable insights, and ensure compliance with all relevant regulations.

In conclusion, successfully forming a company in the Netherlands requires careful planning, research, and understanding of the legal framework. By following these top tips, you'll be well on your way to starting a thriving business in the Netherlands.

Understanding the Legal Requirements for Company Formation in the Netherlands

Company formation in the Netherlands is a straightforward process, but it is important to understand the legal requirements involved. Whether you are a local entrepreneur or an international businessperson looking to expand your operations, knowing the legal framework is essential for setting up a company in the Netherlands.

Types of Business Entities

The first step in company formation is choosing the right type of business entity. The Netherlands offers several options, including:

- Sole Proprietorship: This is the simplest form of business entity, where one person is the owner and is personally liable for the company's debts.

- Partnership: A partnership is an agreement between two or more individuals or companies to share profits and responsibilities. There are two types of partnerships in the Netherlands: general partnerships (VOF) and limited partnerships (CV).

- Private Limited Liability Company (BV): A BV is a separate legal entity with limited liability for its shareholders. It is the most commonly chosen business entity for small and medium-sized enterprises.

- Public Limited Liability Company (NV): An NV is similar to a BV, but it is designed for larger companies that plan to raise capital through public offerings.

Registration Process

Once you have chosen the right type of business entity, you need to register your company at the Dutch Chamber of Commerce (Kamer van Koophandel or KvK). You must provide the necessary documents, such as a notarial deed of incorporation, articles of association, and identification documents of the company's directors and shareholders. The KvK will issue a registration number, which is required for various administrative purposes.

Legal Obligations and Compliance

As a registered company in the Netherlands, you will have certain legal obligations and compliance requirements. These include:

- Financial Statements: All companies must prepare annual financial statements in accordance with Dutch accounting principles.

- Tax Filings: Companies are required to file regular tax returns with the Dutch tax authorities, including corporate income tax, value-added tax (VAT), and payroll taxes.

- Employee Insurance: If you have employees, you are obligated to provide them with employee insurance, such as healthcare, disability, and pension.

- Data Protection: Companies must comply with the General Data Protection Regulation (GDPR) and ensure the proper handling and protection of personal data.

Conclusion

Understanding the legal requirements for company formation in the Netherlands is crucial for a smooth and successful business establishment. By choosing the right business entity and complying with the necessary regulations, you can embark on your entrepreneurial journey confidently. Consult with legal and tax professionals who specialize in Dutch company formation to ensure compliance with all legal obligations.

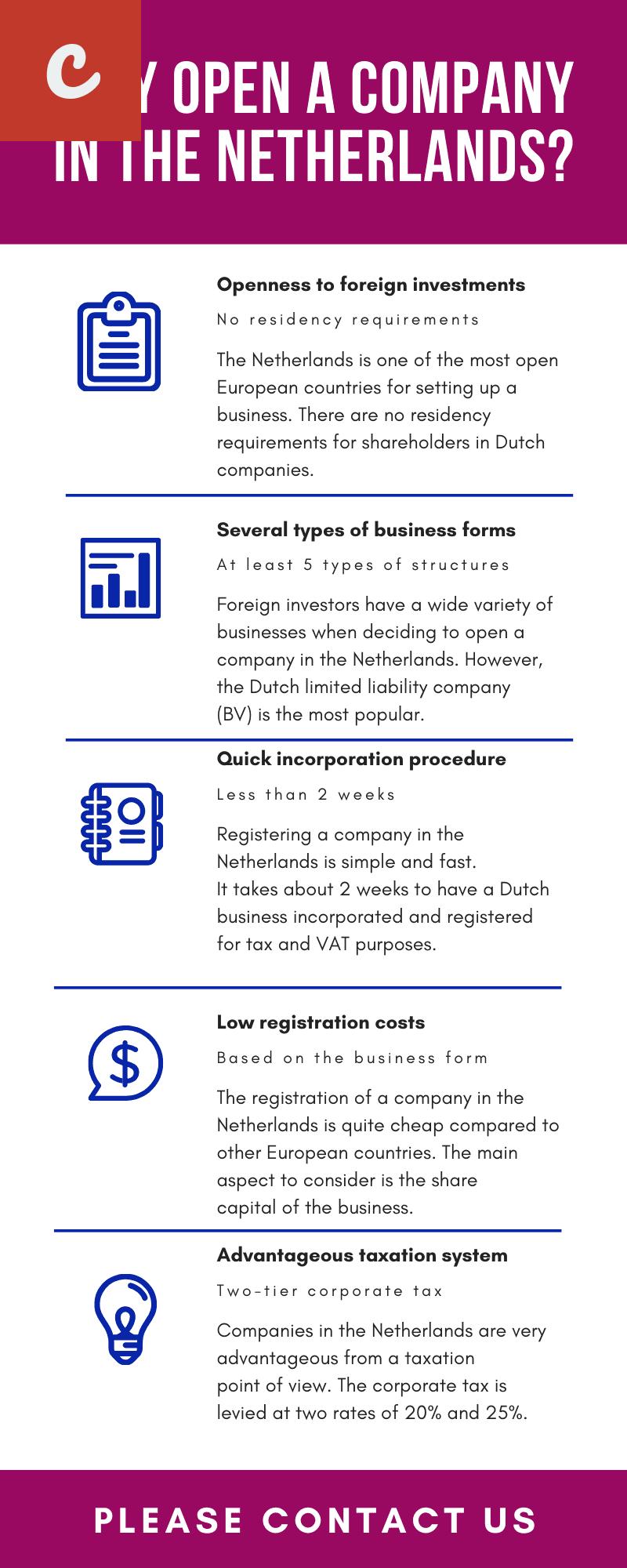

Benefits of Choosing the Netherlands for Your Company Formation

Are you considering forming a company in Europe? The Netherlands can be an excellent choice for your new venture. With its strong economy, favorable business climate, and strategic location, the Netherlands offers a host of benefits for entrepreneurs. In this article, we will discuss some of the key advantages of choosing the Netherlands for your company formation.

First and foremost, the Netherlands has a robust and stable economy. It is consistently ranked as one of the top countries for business and is home to many multinational companies. The country's strong financial infrastructure and skilled workforce make it an attractive destination for entrepreneurs looking to establish their companies.

Moreover, the Netherlands has a favorable business climate that is conducive to growth and innovation. The country has a well-developed legal framework and a strong respect for the rule of law. This makes it a safe and secure environment to do business. Additionally, the Dutch government offers various incentives and support programs for startups and foreign investors, making it easier for companies to establish and operate.

- First, the Netherlands has a highly-educated and multilingual workforce. This makes it easier for companies to find talented professionals who can work in an international business environment.

- Second, the Netherlands has a strategic location within Europe. It has excellent transportation infrastructure and is well-connected to major markets in Europe. This makes it easier for companies to access customers and suppliers throughout the continent.

Furthermore, the Netherlands has an extensive network of tax treaties with other countries. This can be beneficial for companies looking to minimize their tax liabilities and avoid double taxation. The Dutch tax system also offers several attractive tax incentives and favorable tax regulations for businesses, including a participation exemption for qualifying subsidiaries and tax deductions for research and development activities.

In conclusion, there are many reasons why choosing the Netherlands for your company formation can be advantageous. The country's strong economy, favorable business climate, skilled workforce, strategic location, and attractive tax system make it a compelling choice for entrepreneurs. Whether you are starting a new business or expanding your existing one, the Netherlands offers a supportive and conducive environment for growth and success.

Comments on "The Ultimate Guide To Company Formation In The Netherlands"

No comment found!