Main Title: Navigating the Tax Landscape: Company Formation in the Netherlands

Starting a business in a foreign country can be a daunting task, especially when it comes to understanding the tax requirements and regulations. The Netherlands, known for its favorable tax policies, is among the top destinations for entrepreneurs looking to expand their companies internationally. In this article, we will explore the tax landscape and provide an overview of company formation in the Netherlands.

Company formation

Setting up a company in the Netherlands is a straightforward process. There are several business structures to choose from, including a sole proprietorship, partnership, private limited liability company (BV), and branch office. Each structure has its own tax implications, so it is crucial to choose the one that best suits your business needs.

- List item 1: A sole proprietorship is the simplest and most flexible business structure. However, the owner is personally liable for any debts or liabilities.

- List item 2: A partnership involves two or more individuals sharing the profits and losses of the business. They are collectively liable for the debts and liabilities.

Tax advantages in the Netherlands

The Netherlands offers several tax advantages for businesses, making it an attractive location for international entrepreneurs. One of the key benefits is the favorable corporate tax rate. The standard corporate tax rate is currently set at 25%, which is relatively low compared to other countries in Europe.

Additionally, the Netherlands has an extensive network of double tax treaties, which help to prevent double taxation and promote international trade. These treaties ensure that income earned in one country is not taxed twice, providing relief for businesses operating in multiple jurisdictions.

VAT registration

Value Added Tax (VAT) is an indirect tax on goods and services in the European Union (EU). If your business is engaged in taxable activities, you will need to register for VAT in the Netherlands. The standard VAT rate in the Netherlands is 21%, with reduced rates applicable to certain goods and services.

Registering for VAT allows your company to reclaim any VAT paid on business purchases, reducing the overall tax burden. It is important to comply with the VAT regulations and file periodic VAT returns to avoid penalties or legal issues.

Conclusion

Establishing a company in the Netherlands can be a smart move for international entrepreneurs, thanks to its favorable tax policies, simple company formation process, and extensive double tax treaty network. By understanding the tax landscape and choosing the right business structure, you can take advantage of the tax benefits offered in the Netherlands and navigate the tax obligations with ease.

Whether you opt for a sole proprietorship, partnership, BV, or a branch office, consulting with a tax advisor or legal professional is recommended to ensure compliance with all the relevant tax regulations and maximize the tax advantages available to your business.

Demystifying Taxation: What You Need to Know About Company Formation in the Netherlands

Starting a company is an exciting venture, but it can also be a complex process, particularly when it comes to navigating the intricacies of taxation. One country that offers favorable conditions for company formation is the Netherlands. With its competitive tax regime and robust business environment, the Netherlands has become a popular choice for entrepreneurs looking to establish their businesses.

The Netherlands follows a territorial taxation system, which means that companies are only taxed on their Dutch-sourced income. This provides an advantage for companies with international operations, as they can benefit from the country's extensive network of tax treaties, minimizing the risk of double taxation.

- First List item

- Second List item

Additionally, the Netherlands has a favorable corporate tax rate. In 2021, the standard corporate tax rate is set at 15%. This competitive rate makes the country an attractive destination for businesses looking to optimize their tax liabilities.

Company formation in the Netherlands requires careful planning and adherence to specific legal requirements. Here are the key steps involved in the process:

- Choose a legal entity: The first step is to determine the legal structure of your company. The most common types of entities in the Netherlands are the private limited company (BV) and the public limited company (NV).

- Registration with the Dutch Commercial Register: Every company in the Netherlands must be registered with the Dutch Commercial Register. This registration will provide your company with a unique identification number.

- Appoint a director and a registered office: Your company needs to have at least one director and a registered office in the Netherlands. The director is responsible for managing the company's affairs, and the registered office is the official address of the company.

- Prepare the articles of association: The articles of association outline the rules and regulations that govern your company. It is a crucial document that should be prepared carefully and in accordance with Dutch law.

Once your company is formed, you will need to comply with ongoing tax obligations in the Netherlands. This includes filing regular tax returns, maintaining proper accounting records, and paying taxes on time.

In conclusion, the Netherlands offers a favorable tax environment for company formation. Its territorial taxation system, competitive corporate tax rate, and extensive network of tax treaties make it an attractive destination for entrepreneurs. However, it is essential to navigate the legal requirements and comply with tax obligations to ensure a successful and compliant business.

Maximizing Profitability: Unraveling the Tax Implications of Company Formation in the Netherlands

In today's global business landscape, companies constantly seek opportunities to maximize profitability and minimize tax burdens. The Netherlands has emerged as a favored destination for entrepreneurs and businesses due to its attractive tax regime and strategic location within Europe.

When it comes to company formation, understanding the tax implications is essential. By gaining insight into the Netherlands' tax system, entrepreneurs can make informed decisions that ultimately result in greater profitability.

- Corporate Income Tax: The corporate income tax rate in the Netherlands is 25% on taxable profits up to €200,000 and 20% on profits exceeding this threshold. This rate is competitive compared to other European countries.

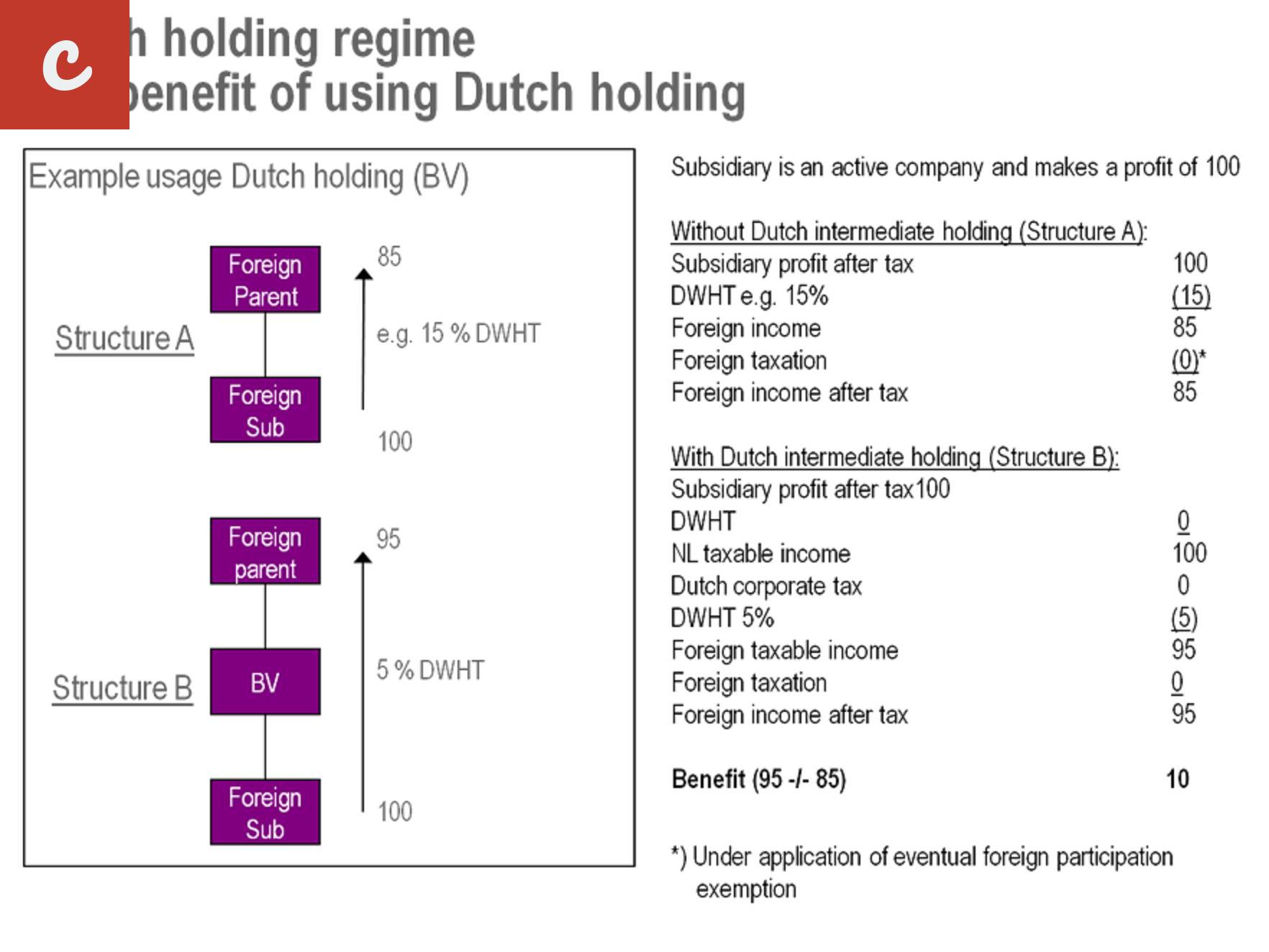

- Participation Exemption: The Netherlands offers a participation exemption that allows companies to avoid taxation on profits derived from substantial shareholdings in other companies. This exemption applies to both domestic and foreign subsidiaries that meet certain criteria.

- Tax Treaties: The Netherlands has an extensive network of tax treaties with over 100 countries. These treaties aim to prevent double taxation and provide opportunities for tax optimization. By utilizing the benefits of tax treaties, companies can reduce their overall tax burden.

Furthermore, the Netherlands offers various tax incentives to foster innovation and growth. One such incentive is the Research & Development (R&D) Tax Credit. Companies engaged in qualifying R&D activities can receive a tax credit of up to 40% of their eligible R&D costs.

Another attractive tax benefit is the Innovation Box regime. Under this regime, profits derived from qualifying intellectual property are subject to a reduced corporate income tax rate of 7%. This incentive encourages companies to invest in innovative products and technologies.

Lastly, the Netherlands provides a favorable environment for international holding companies. The country has introduced the Dutch Cooperative as an alternative to traditional holding structures. This legal entity allows for flexible profit allocations and can greatly optimize tax efficiency.

In conclusion, understanding the tax implications of company formation in the Netherlands is crucial for businesses aiming to maximize profitability. The competitive corporate income tax rate, participation exemption, extensive tax treaty network, and various tax incentives all contribute to the country's attractiveness as a business destination. By leveraging these benefits and making informed decisions, companies can secure a more favorable tax position and ultimately enhance their bottom line.

Mastering Tax Compliance: A Guide to Company Formation in the Netherlands

When it comes to company formation, the Netherlands is a popular choice for entrepreneurs due to its favorable tax climate and business-friendly environment. However, navigating the complexities of tax compliance can be a daunting task. In this guide, we will provide you with valuable information on how to master tax compliance when setting up your company in the Netherlands.

1. Research and Understand the Tax System

Before diving into the process of company formation, it is crucial to do your research and understand the tax system in the Netherlands. The Dutch tax system is known for its transparency and efficiency, but it can still be intricate for newcomers. Familiarize yourself with the different types of taxes, such as corporate income tax, value-added tax (VAT), and payroll taxes.

2. Seek Professional Advice

While it is possible to handle tax compliance on your own, seeking professional advice can save you time, money, and potential headaches. Hiring a reputable tax advisor or accountant specialized in Dutch tax law can provide invaluable guidance throughout the company formation process. They can assist you in understanding tax obligations, important deadlines, and help you optimize your tax structure for maximum efficiency.

- List item 1: Make sure to choose a tax advisor or accountant with experience in company formation in the Netherlands. They should be well-versed in Dutch tax regulations and have a track record of helping businesses navigate tax compliance successfully.

- List item 2: Consult with your tax advisor on the most suitable legal structure for your company. The Netherlands offers different types of business entities, such as sole proprietorship, partnership, limited liability company (BV), and public limited company (NV). Each structure has its own tax implications, so it's important to choose the one that aligns with your business goals and tax strategy.

3. Register with the Dutch Tax Authorities

As part of your tax compliance obligations, you will need to register with the Dutch Tax Authorities. You can do this by obtaining a Dutch tax identification number (TIN). This unique identification number is essential for conducting business activities and fulfilling tax obligations in the Netherlands.

During the registration process, you will need to provide various information about your company, such as its legal structure, activities, and financial details. It is important to gather all the necessary documents and submit them accurately to avoid any delays or penalties.

4. Stay Up to Date with Tax Regulations

Tax regulations are subject to change, and it is crucial to stay informed and up to date with any revisions that may affect your company. The Dutch Tax Authorities regularly release updates, new guidelines, and legislative changes. Subscribe to their newsletters, follow reputable tax websites, and attend tax seminars or workshops to keep yourself informed.

Additionally, engaging with professional networks and organizations can provide you with valuable insights and access to resources that can help you stay ahead of the curve.

Mastering tax compliance when forming a company in the Netherlands requires careful planning, research, and the right professional guidance. By taking these steps, you can ensure that your business operates smoothly and complies with all the necessary tax obligations in this business-friendly country.

Main Title

Starting a company can be an exciting and daunting prospect. As an entrepreneur, it's essential to have a sound understanding of the tax implications that come along with company formation in the Netherlands. The Netherlands is known for its favorable business climate, but it's crucial to navigate the tax system to stay ahead of the game.

One of the key factors to consider when establishing a company in the Netherlands is the corporate income tax. Companies are subject to a flat rate corporate income tax, currently set at 25%. This rate applies to the company's taxable profits, which are calculated by subtracting deductible expenses from the total revenue.

The Netherlands also offers various tax incentives to promote entrepreneurship and research and development activities. One of the most notable incentives is the Innovation Box regime. This regime allows companies to benefit from a reduced corporate income tax rate of 7% on profits derived from qualifying intellectual property (IP) assets.

Furthermore, the Netherlands has an extensive network of double tax treaties with more than 90 countries. These treaties aim to avoid double taxation and provide relief for foreign investors. For instance, a company established in the Netherlands can benefit from reduced withholding tax rates on dividends, interest, and royalties received from treaty countries.

- List item 1: Value Added Tax (VAT)

- List item 2: Payroll Taxes

Another important aspect to consider is the Value Added Tax (VAT) system in the Netherlands. Generally, companies engaged in taxable activities must charge VAT on their products or services. The standard VAT rate in the Netherlands is currently 21%, but reduced rates of 9% and 0% apply to specific goods and services. It's vital to understand the rules and regulations surrounding VAT to comply with Dutch tax law.

Additionally, when forming a company in the Netherlands, it's important to be aware of payroll taxes. Employers are required to withhold and remit employee taxes, including income tax and social security contributions. Understandably, payroll tax obligations can have a significant impact on the company's financials, so it's crucial to comply with Dutch payroll tax regulations.

In conclusion, being informed about the tax implications of company formation in the Netherlands is crucial for any entrepreneur. By understanding corporate income tax, tax incentives, double tax treaties, VAT, and payroll taxes, businesses can navigate the tax landscape and stay ahead of the game. Consult with tax professionals to ensure compliance and to maximize the benefits available to your company.

Comments on "Understanding The Tax Implications Of Company Formation In The Netherlands"

No comment found!